Pi Network has moved beyond being a blockchain experiment it has become a political and economic symbol. As President Donald Trump outlines his sweeping financial strategy, Pi is emerging at the center of debate, framed as an antidote to legacy greed through its model of unpaid contribution and decentralized value.

This analysis explores Trump’s pivot, showing how Pi exposes the emptiness of profit-driven systems while introducing a new philosophy based on participation and contribution.

Legacy Greed vs. Contribution

For decades, global finance has been built on profit margins and centralized power. Trump’s recent remarks suggest a break from these legacy structures. In contrast, Pi Network reflects a grassroots economy, grounded in six years of voluntary participation by millions of pioneers.

That record of contribution not capital has created a form of moral authority. By suggesting Pi Network as a candidate for a U.S. crypto reserve, Trump’s move is less about technology than philosophy.

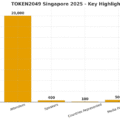

Open Mainnet: A Historic Shift

On February 20, 2025, Pi launched its Open Mainnet, enabling real-world payments, decentralized apps, and external wallet integration. As observers like @applekhankorea note, this wasn’t just a technical event—it was a turning point.

With 75M users and more than 100 dApps, Pi has become a full Web3 ecosystem. Its infrastructure now includes:

- Smart contracts via Soroban

- Parallel transaction processing

- Decentralized KYC (ERC-3643)

- Biometric authentication with Passkey

- Linux Node support for institutions

This positions Pi as a functional alternative to traditional systems, capable of scaling a contributory economy.

Six Years of Contribution as Foundation

From day one, Pi’s model has depended on unpaid engagement: pioneers mined, verified, and built without financial reward. That long stretch of voluntary participation now stands as the moral counterweight to profit-centered dominance.

Trump’s strategy seems to recognize this, reframing value around contribution rather than capital.

Forcing Integration

Resistance remains—legacy institutions are uneasy with decentralization. But Pi’s growing adoption on platforms like Swapfone (BTCC) and Valour Pi ETP shows momentum. The strategy is simple: demonstrate real-world utility, scale, and moral legitimacy until acceptance becomes inevitable.

Picoin: Currency of Contribution

Picoin, earned through verified participation, is capped in supply and resistant to inflation. Its base mining rate was cut to 0.0027405 Pi/hour in September, reinforcing scarcity. Unlike hype-driven tokens, Picoin serves peer-to-peer payments, merchant adoption, and governance functions—making it a genuine currency of contribution.

Institutional Reach

Institutional attention is building. Sweden’s Valour Pi ETP manages nearly $947M in assets, while integration with Onramp Money gives Pi fiat access in over 60 countries. These steps show Pi can operate in regulated financial environments with scalable compliance tools.

Strategic Ripple Effects

Trump’s endorsement shook markets: Bitcoin fell, while Pi trading interest climbed. This signals a deeper shift away from dominance rooted in capital toward legitimacy earned through contribution. With Pi already active in 200+ countries, its influence is extending beyond crypto into global economic dialogue.

Ongoing Challenges

Volatility, governance centralization, and scaling issues remain. With 82.8% of supply still under Core Team control, balancing oversight and decentralization is key. Yet, with the PiOS codebase 90% complete and DAO frameworks under testing, the network is edging closer to community-led governance.

What’s Ahead

Pi’s roadmap includes:

- Full Soroban smart contract rollout

- Staking and DAO governance expansion

- Pi-powered marketplaces and ID services

- Continued dApp development

- Listings on major exchanges

Each milestone strengthens Pi’s place within the contributory economy.

Conclusion: A New Narrative in Finance

Trump’s pivot reframes crypto: Pi Network is no longer fringe but a symbol of decentralized power, participation, and shared value. Legacy systems now face the limits of their profit-driven model, while Pi pioneers are writing a new script where trust and contribution define currency.

This analysis suggests the future of finance may not be led by institutions, but by contributors. And at the center of that shift stands Pi Network.

uxk6cf

مولتی ویتامین موتانت، یک

مکمل جامع و قدرتمند است که بهطور خاص برای نیازهای ورزشکاران و بدنسازان طراحی شده است.

پروتئین وی ایزوله، دارای پروتئین بالا و چربی و کربوهیدرات پایینتری نسبت به سایر انواع پروتئین است.

پروتئین وی هیدرولیز، باعث میشود تا با سرعت بیشتری به هدف موردنظرکه اندامی خوش فرم است برسید.

پروتئین وی، باعث میشود تا با سرعت بیشتری به هدف موردنظرکه اندامی خوش فرم است برسید.

فیتنس مکمل، دارای بهترین مکمل های خارجی و اورجینال، شامل پروتئین وی و…

پروتئین کازئین، یکی از دو پروتئین اصلی موجود در شیر است (پروتئین دیگر، آب پنیر یا وی است).

مکمل کراتین، مکملی محبوب در دنیای بدنسازی و ورزش، ترکیبی طبیعی است که از سه اسیدآمینه آرژنین، گلایسین و متیونین در بدن تولید میشود.

مکمل پروتئین، این ماکرومغذی قدرتمند، اساس ساختار سلولها و عضلات ماست.

مکمل کراتین مونوهیدرات، یک ترکیب طبیعیه که از سه اسید آمینه گلیسین، آرژنین و متیونین ساخته میشه و به طور عمده در عضلات اسکلتی ذخیره میشه.

مولتی ویتامین، مکملهایی هستند که ترکیبی از ویتامینها و مواد معدنی ضروری را در یک قرص یا کپسول گرد هم میآورند.

مکمل ویتامین، مواد حیاتی ای است که بدن ما برای عملکرد صحیح به آنها نیاز دارد.

مکمل کراتین ترکیبی، مثل یه تیم فوتبال حرفهای میمونه که هر بازیکنش یه کار خاص رو به نحو احسن انجام میده.

کراتین مونوهیدرات اسکال لبز 300 گرمی، یعنی کیفیت و خلوص! اسکال لبز (Skull Labs) یک برند لهستانیه که در تولید مکملهای ورزشی با کیفیت بالا شناخته شده.

کراتین ایوژن، یک مکمل غذایی باکیفیت است که

به طور خاص برای بهبود عملکرد ورزشی و حمایت از رشد عضلانی

طراحی شده.

وی زو زومد لبز، محصولی فوقحرفهای و باکیفیت است که با ترکیبات استثنایی و طعمهای جذاب، انتخابی عالی برای ورزشکاران محسوب میشود.

کازئین میسلار کوامترکس 900 گرمی، یک پروتئین با جذب بسیار آهسته است که برای تأمین مداوم اسیدهای آمینه به عضلات، به ویژه در طول شب و ساعات طولانی بین وعدههای غذایی، طراحی شده است.

کراتین استروویت، یک مکمل باکیفیت و تکجزئی است که به عنوان یکی از موثرترین انواع کراتین در جهان شناخته میشود.

کراتین ایوژن، یک مکمل غذایی باکیفیت است که به طور خاص برای بهبود عملکرد ورزشی و حمایت از رشد عضلانی طراحی شده.

مولتی ویتامین سوپر ویت کوامترکس 120 عددی، یک مکمل مولتیویتامین و مولتیمینرال جامع است که توسط برند معتبر کوامترکس تولید میشود.

ماسل رولز، وی رولز پلاس ماسل رولز ترکیبی از پروتئین وی ایزوله و کنسانتره است.

وی گلد استاندارد اپتیموم نوتریشن 900 گرمی، با استفاده از فناوریهای فیلترینگ پیشرفته، عمدتاً از پروتئین وی ایزوله تهیه میشود که چربی، کربوهیدرات و لاکتوز اضافی آن حذف شده است.

کراتین مای پروتئین یک کیلویی، یکی از محبوبترین و بهترین مکملهای کراتین در جهان است که به دلیل خلوص و کیفیت بالا، سالهاست که در سایت ما رتبه اول را به خود اختصاص داده است.

وی ایزوله ایوژن، یک پروتئین وی ایزوله با خلوص فوقالعاده بالاست که توسط شرکت معتبر Evogen Nutrition تولید میشود.

کراتین ترکیبی ناترکس 1300 گرمی، یک محصول پیشرفته برای بارگیری گلیکوژن و کراتین است که برای به حداکثر رساندن عملکرد و حجم عضلات طراحی شده.

وی اکستریم ناپالم فا، یک پروتئین وی کنسانتره باکیفیت و پیشرفته است که برای به حداکثر رساندن عملکرد و ریکاوری ورزشکاران طراحی شده است.

پروتئین کازئین چیست ؟، نوعی پروتئین از گروه فسفو پروتئینهاست که به طور طبیعی در شیر پستانداران وجود دارد.

مولتی ویتامین فارماتون 100 عددی، یک مکمل غذایی کامل و جامع است که با هدف افزایش انرژی و کاهش خستگی طراحی شده است.

وی ایزوله ویسلی، پودری با 6 گرم BCAA و 14 گرم EAA در هر سروینگ است که با روش میکروفیلتراسیون جریان متقاطع تولید میشود.

مولتی ویتامین اپتی من، یک مولتی ویتامین جامع و قدرتمند است که به طور اختصاصی برای نیازهای تغذیهای آقایان، به ویژه ورزشکاران، طراحی شده است.

وی ایزوله ایزوفیت ناترکس 1 کیلویی، یک مکمل پروتئینی فوقالعاده باکیفیت است که با فرآیند میکروفیلتراسیون پیشرفته تولید شده است.

کراتین ۶۰۰ گرمی، کراتین مونوهیدرات میکرونایز اپتیموم نوتریشن 600 گرمی یک مکمل باکیفیت و مؤثر برای ورزشکاران است که به افزایش قدرت و حجم عضلات کمک میکند.

کراتین مونوهیدرات اسپرتر 500 گرمی، یک مکمل غذایی است که به صورت پودر عرضه میشود و هدف اصلی آن افزایش ذخایر فسفوکراتین در عضلات است.

بهترین مکمل ها برای دوران کات، پروتئین وی و BCAA برای حفظ عضلات، الکارنیتین و CLA برای به حداکثر رساندن چربیسوزی، و کافئین و بتا آلانین و …

وی ویتوبست 100%، یک منبع غنی و طبیعی از اسیدهای آمینه شاخهدار (BCAAs) و ال-گلوتامین به حساب میآید.

بهترین برندهای پروتئین وی خارجی، ماسلتک (Muscletech) گرفته تا استاندارد طلایی بازار یعنی اپتیموم نوتریشن (Optimum Nutrition)، یا خلوص بینظیر رول وان (Rule One)، و …

مولتی ویتامین بانوان رول وان، یک مکمل تغذیهای فوقالعاده جامع است که به طور اختصاصی برای برآورده کردن نیازهای تغذیهای بانوان فعال و ورزشکار طراحی شده است.

کراتین مونوهیدرات چیست؟، در هسته اصلی، کراتین مونوهیدرات سادهترین و خالصترین شکل کراتین است که به صورت تجاری در دسترس قرار دارد.

وی ایزوله سون نوتریشن، در هستهی خود، یک مکمل پروتئین وی ایزوله بسیار خالص است که با هدف رساندن حداکثر پروتئین و حداقل چربی، کربوهیدرات و لاکتوز به بدن طراحی شده.

وی بلو لب، ترکیبی از وی ایزوله میکروفیلتردار، وی کنسانتره و وی هیدرولیز است که جذب بالایی دارد.

تفاوت پروتئین وی با وی ایزوله، در میزان خلوص، فرآیند تولید و در نتیجه محتوای ماکروها (پروتئین، چربی، کربوهیدرات و لاکتوز) خلاصه میشه.

کراتین ترکیبی ویتوبست، یکی از پیشرفتهترین مکملهای کراتین موجود در بازار جهانی است که با فرمولاسیونی علمی و جامع برای به حداکثر رساندن عملکرد ورزشکاران طراحی شده است.

وی اینر آرمور، از پروتئین گاوهای علفخوار نیوزلندی تهیه شده

و سرشار از لوسین، یکی از آمینو اسیدهای شاخهای (BCAA)، است.

مکمل وی رونی کلمن، با ارائه ۲۵ گرم پروتئین خالص در هر سروینگ، به بدن شما کمک میکند تا بلوکهای سازنده لازم برای ترمیم و ساخت بافتهای عضلانی آسیبدیده در طول تمرینات شدید را داشته باشد.

پروتئین وی یا گینر، این دو مکمل، با وجود شباهتهایی که در بحث عضلهسازی دارن، از لحاظ ترکیبات و کارایی، مثل شب و روز با هم فرق میکنن.

وی ماسل کور، با داشتن ترکیبی از وی ایزوله و کنسانتره میکروفیلتر شده و هیدرولیزات، سرعت جذب بالایی داره و مواد مغذی رو “مستقیم به هدف” میرسونه.

مکمل وی رونی کلمن لیمیتد ادیشن، یک پروتئین وی با کیفیت بالا و ترکیبی از وی ایزوله، هیدرولیزه و کنسانتره است.

وی سیکس استار، ترکیبی از ایزوله و پروتئین وی (کنسانتره) با خلوص بالا است که بهراحتی در بدن جذب میشود.

ایا مصرف کراتین موجب ریزش مو می شود؟، خیر هیچ ارتباطی بین کراتین و ریزش مو وجود ندارد.

وی بی اس ان، حاوی ۲۴ گرم پروتئین ترکیبی (وی کنسانتره، ایزوله، هیدرولیزه، کازئین و پروتئین شیر) است.

کراتین ترکیبی ایوژن 300 گرمی، مکملی است که فراتر از کراتین مونوهیدرات استاندارد عمل میکند و برای به حداکثر رساندن جذب، پایداری و کارایی در بدن طراحی شده است.

وی سوپریم، حاصل سالها تجربه و دانش یکی از اسطورههای بدنسازی، کوین لورون، است.

وی ناترکس، مکملی با کیفیت بالاست که برای کمک به رشد و ریکاوری عضلات طراحی شده است.

وی اتمیک، یک مکمل پودری است که به راحتی در مایعات حل میشود و به شما کمک میکند تا پروتئین باکیفیت به رژیم غذاییتان اضافه کنید.

وی انابولیک کوین، یک فرمول پیشرفته پروتئینی است که از ۵ منبع مختلف شامل وی کنسانتره، وی ایزوله، وی هیدرولیزه، کازئین و آلبومین تخممرغ تشکیل شده است.

وی ماسل رولز پرو، با فرمولاسیونی خاص، مکملی ایدهآل برای تمام افرادی است که به دنبال تأمین پروتئین روزانه خود هستند.

وی پرو آنتیوم رونی کلمن، حاوی ۱۳.۵ گرم EAA، ۳.۵ گرم BCAA، ۵ گرم کراتین و ۲.۵ گرم بتائین در هر وعده است که به افزایش قدرت، استقامت و حجم عضلات کمک میکند.

مولتی ویتامین انیمال یونیورسال پک 30 تایی، یک بسته کامل و جامع حاوی بیش از ۶۰ تا ۸۵ ماده مغذی کلیدی در هر ساشه (بسته) روزانه است!

پروتئین وی fa، یک مکمل خوشطعم و باکیفیت است که حاوی ۱۰۰٪ پروتئین وی کنسانتره (Whey Concentrate) میباشد.

وی پرو موتانت، یک مکمل پروتئینی پیشرفته و کامل است که برای حمایت از رشد سریع عضلات، ریکاوری، و سلامت عمومی طراحی شده است.

پروتئین وی کریتیکال اپلاید، ترکیبی پیشرفته از پروتئین وی کنسانتره، ایزوله و هیدرولیز شده است.

وی ایزوله دایماتیز 1400 گرمی، نه تنها پروتئین وی ایزوله (Whey Isolate) است، بلکه از نوع هیدرولیز شده (Hydrolyzed) نیز هست.

پروتئین وی الیمپ، با فناوری CFM، نقش مؤثری در عضلهسازی، ریکاوری سریع پس از تمرین و چربیسوزی دارد.

وی ناترند کیسه ای، در واقع یک مکمل پروتئینی باکیفیت و حرفهای است که توسط شرکت معتبر اروپایی Nutrend تولید میشود.

وی ویسلی، یک مکمل با کیفیت بر پایه کنسانتره پروتئین وی و پروتئین آبپنیر است.

وی ناترند، مکملی با کیفیت بالا برای رشد عضلات، جلوگیری از تحلیل عضلانی و تأمین پروتئین روزانه ورزشکاران است.

کراتین انابولیک کوین لورون 300 گرمی، یک مکمل غذایی متشکل از کراتین مونوهیدرات خالص با خلوص بالاست.

وی نیتروتک گلد، ترکیبی از پروتئین وی ایزوله و کنسانتره است. این ترکیب به معنای دریافت پروتئین با سرعت جذب بسیار بالا و کیفیت بینظیر است.

وی نیتروتک، دارای فناوری فیلتراسیون چند فازی است.

وی ایزوله موتانت 727 گرمی، در اصل یک مکمل پودری پروتئینی فوقالعاده با کیفیت است که عمدتاً از پروتئین وی ایزوله و همچنین پروتئین وی هیدرولیز شده تشکیل شده است.

وی ایزوله ماسل اسپرت، مکملی با کیفیت بالا و مناسب برای افزایش توده عضلانی بدون چربی، چربیسوزی و بهبود ریکاوری است.

پروتئین هگزا پرو المکس، یک مکمل پروتئینی پیشرفته و باکیفیت است که برای تغذیه طولانیمدت عضلات ورزشکاران طراحی شده است.

وی استروویت، یک منبع پروتئین و کربوهیدرات پیچیده است که هضم و جذب بسیار سریعی دارد و در معده باقی نمیماند.

قیمت وی ایزوله ناترکس، به نسبت کیفیت ان بسیار پایین است و ایزوفیت کم قند، چربی، کربوهیدرات و کالری بوده.

وی ایزوله استروویت، با تامین سریع و باکیفیت تمام آمینو اسیدهای ضروری، به ویژه آمینو اسیدهای شاخهدار ، به کاهش خستگی مرکزی کمک میکند.

کراتین اینر آرمور، میتواند به شما در ریکاوری و بهبود عملکرد ورزشی کمک کند.

وی ایزوله ماسل تک 1 کیلویی، در واقع یک پودر پروتئین آب پنیر ایزوله شده است که با تکنولوژیهای پیشرفته میکروفیلتراسیون و اولترافیلتراسیون فرآوری شده.

وی ایزوله اپلاید نوتریشن ایکس پی، یک مکمل پروتئین وی ایزوله ۱۰۰% خالص است که توسط شرکت بریتانیایی تولید میشود.

کراتین ویسلی 300 گرمی، در واقع نام تجاری یک مکمل ورزشی است که معمولاً حاوی کراتین مونوهیدرات خالص میباشد.

وی بلولب یو اس ان، ترکیبی از وی ایزوله میکروفیلتردار، وی کنسانتره و وی هیدرولیز است که جذب بالایی دارد.

وی کیسه ای اپتیموم، یکی از پرفروشترین پودرهای پروتئین وی در دنیاست.

وی ناترند ۱ کیلویی، در واقع یک مکمل پروتئینی باکیفیت و حرفهای است که توسط شرکت معتبر اروپایی تولید میشود.

وی ایزوله ایزوجکت ایوژن، از تصفیه سهگانه با فیلتر سرد (Triple Cold-Filtered) بهره میبرد.

وی سینتا 6 بی اس ان 1 کیلویی، یک ماتریس پروتئینی فوق حرفهای است که برای حمایت مداوم از عضلات شما، در تمام طول روز و شب طراحی شده است.

وی الیمپ کیسه ای، یک ترکیب حرفهای از دو نوع پروتئین وی با کیفیت فوقالعاده است.

مولتی ویتامین ایوژن، توسط یک برند معتبر در دنیای فیتنس تولید شده و فرمولاسیون آن به طور خاص برای کسانی بهینه شده است که در سطح بالایی از فعالیت بدنی قرار دارند.

کراتین ترکیبی سل تک ماسل تک، یک فرمولاسیون پیشرفته است که برای به حداکثر رساندن جذب و کارایی کراتین در سطح سلولی طراحی شده است.

اپتی من، یک مولتی ویتامین جامع و قدرتمند است که به طور اختصاصی برای نیازهای تغذیهای آقایان، به ویژه ورزشکاران، طراحی شده است.

کراتین ترکیبی انابولیک کوین لورون، نتیجهی سالها تجربه و علم پشت سر یکی از اسطورههای بزرگ بدنسازی، کوین لورون، هست.

کراتین ترکیبی موتانت، از سه نوع کراتین مختلف را در خود جای داده است تا حداکثر جذب، کارایی و حداقل عوارض جانبی را تضمین کند.

کراتین ترکیبی انیمال یونیورسال، یک فرمولاسیون پیشرفته و چندگانه است که برای به حداکثر رساندن قدرت و عملکرد ورزشی طراحی شده.

کراتین چیست، یک ترکیب طبیعی است که در بدن انسان تولید میشود و نقش کلیدی در تأمین انرژی سریع و قدرتمند برای عضلات ایفا میکند.

وی رول وان، یکی از مکملهای برجسته در بازار جهانی است که عمدتاً برای حمایت از عضلهسازی، ریکاوری سریع، و بهبود کلی عملکرد ورزشی طراحی شده است.

ایزوفیت، وی ایزوله ایزوفیت ناترکس حاوی ۲۵ گرم پروتئین وی ایزوله ۱۰۰٪ در هر سروینگ است که با روش میکروفیلتراسیون پیشرفته تولید شده و جذب سریع دارد.

وی بی پی ای HD، در واقع یک ترکیب فوقپیشرفته از پروتئینهای وی با سرعت جذب متفاوت است.

وی ایزوله ایوژن اصل، از تصفیه سهگانه با فیلتر سرد (Triple Cold-Filtered) بهره میبرد.

کازئین، یکی از دو پروتئین اصلی موجود در شیر است (پروتئین دیگر، آب پنیر یا وی است).

پروتئین کازئین اپلاید نوتریشن، یک مکمل حیاتی و ایده آل برای ورزشکارانی است که به دنبال سوخترسانی طولانیمدت به عضلات خود هستند.

وی ایزوله ایوژن، از تصفیه سهگانه با فیلتر سرد (Triple Cold-Filtered) بهره میبرد.

کراتین رول وان، یک مکمل غذایی-ورزشی بسیار با کیفیت است که عمدتاً از کراتین مونوهیدرات خالص و میکرونیزه تشکیل شده است.

مولتی ویتامین رول وان اقایان، با بیش از ۵۰ ماده فعال، شامل ۲۴ ویتامین و ماده معدنی ضروری، آمینو اسیدها، آنزیمهای گوارشی، و عصارههای گیاهی، یک سر و گردن از مولتی ویتامینهای بازاری بالاتر است.

کراتین رول وان 400 گرمی، یکی از معدود مکملهایی است که توسط اکثر سازمانهای معتبر ورزشی و پزشکی تأیید شده است.

کراتین استروویت 500 گرمی، یک مکمل کراتین مونوهیدرات خالص با کیفیت بالاست که توسط شرکت معتبر OstroVit تولید شده است.

وی ایزوله رول وان، از پروتئین آب پنیر ایزوله و هیدرولیز شده تهیه شده، یعنی خالصترین شکلی از پروتئین که میتوانید پیدا کنید.

وی اسکال لبز،

با تکیه بر فرمولاسیون پیشرفته و خلوص بالا،

نامی برای خود دست و پا کرده است.

وی اسکال لبز، با تکیه بر فرمولاسیون پیشرفته و خلوص بالا، نامی برای خود دست و پا کرده است.

وی ایزوله اسکال لبز، یکی از خالصترین و باکیفیتترین پروتئینهای موجود در بازار مکملهای ورزشی است که توانسته جایگاه خوبی بین ورزشکاران حرفهای پیدا کند.

کراتین بست بی پی ای، با ارائه فرمهای مختلف، این اطمینان حاصل کرده که بدن شما حداکثر میزان کراتین رو دریافت و ذخیره میکنه.

پروتئین کازئین میسلار فا، همانطور که از نامش پیداست، از برند معتبر FA (Fitness Authority) و یک پروتئین کامل است که از شیر استخراج میشود.

وی انیمال یونیورسال، ترکیب قدرتمندی از پروتئین وی ایزوله و کنسانتره فوقفیلتر شده است که طراحی شده تا دقیقاً اون چیزی رو به عضلات شما بده که برای رشد سریع، ریکاوری بهتر و عملکرد بالاتر بهش احتیاج دارند.

کراتین انیمال یونیورسال، با فرمولاسیون خالص مونوهیدرات خود، تمام آن چیزی است که شما از یک مکمل کراتین درجه یک انتظار دارید و هیچ چیز اضافی و فیلری در آن نیست.

پروتئین کازئین گلد کوین لورون، با فرمولاسیون ممتاز خود که معمولاً حاوی “کازئین میسلار” (Micellar Casein) است، اطمینان میدهد که جریان ثابتی از آمینو اسیدهای ضروری را دارد.

کراتین ترکیبی فا نوتریشن، با ترکیبی از اشکال مختلف کراتین مانند کراتین هیدروکلراید (HCl)، دی کراتین مالات، و کراتین آلفا کتوگلوتارات (AKG) روبرو هستید.

مکمل امگا 3، اسیدهای چرب حیاتی هستند که بدن ما نمیتواند خودش تولید کند.

مکمل امگا 3 رول وان، با اسیدهای چرب امگا 3، به ویژه EPA (ایكوزاپنتانوئیك اسید) و DHA (دوكوزاهگزائنوئیك اسید)، نه فقط برای قلب و عروق خوبن، بلکه قسمت عمدهای از بافت مغز رو تشکیل میدن.

ال وی کلاسیک المکس، یک مکمل پروتئین وی ترکیبی و باکیفیت است که توسط کمپانی معتبر AllMax Nutrition کانادا تولید میشود.

کراتین ال مکس 100 گرمی، یک مکمل کراتین مونوهیدرات بسیار خالص و با کیفیت دارویی است که توسط کمپانی کانادایی AllMax Nutrition عرضه میشود.

وی ایزوله انابولیک کوین لورون، یک مکمل پروتئین وی بسیار پیشرفته است که توسط برند ورزشی Kevin Levrone Signature Series تولید میشود.

گینر مای پروتئین 2/5 کیلویی، یک مکمل غذایی با کالری و کربوهیدرات بالا است که برای ورزشکاران، بدنسازان و افرادی که به سختی وزن اضافه میکنند (Ectomorphs) طراحی شده است.

مکمل گینر، که گاهی با نامهایی چون Weight Gainer یا Mass Gainer نیز شناخته میشود، یک مکمل غذایی پرکالری است که برای کمک به افرادی که در افزایش وزن و حجم عضلانی مشکل دارند (معمولاً افراد دارای متابولیسم بالا یا اکتومورفها) طراحی شده است.

پرو گینر اپتیموم نوتریشن گلد استاندارد، پاسخی هوشمندانه به نیاز ورزشکارانی است که نمیخواهند با مصرف کالریهای بیهوده، زیبایی اندام خود را فدای حجم کنند.

امگا 3 مای ویتامینز 250 عددی، یک مکمل غذایی پرطرفدار است که توسط برند معتبر بریتانیایی Myvitamins تولید میشود.

وی ایزوله بی پی ای، یک مکمل پروتئین وی با کیفیت فوقالعاده بالا است که توسط کمپانی BPI Sports تولید میشود.

گینر موتانت ۳ کیلویی، یک مکمل افزایش وزن و حجم عضلانی (Mass Gainer) است که توسط کمپانی Mutant تولید میشود.

گینر یو اس ان ۴ کیلویی، در واقع اشاره به یکی از محصولات پرطرفدار و باکیفیت شرکت یو اس ان (USN) دارد.

کراتین ترکیبی ماسل تک 1 کیلویی، در واقع به “پادشاه کراتینهای ترکیبی” اشاره دارد.

مولتی ویتامین اپتی وومن 60 عددی، پاسخ قاطع این کمپانی به نیازهای خاص بدن زنان است.

وی دایت اپلاید نوتریشن، یک مکمل هیبریدی یا ترکیبی پیشرفته است.

پروتئین وی ایزوله دایماتیز، یک مکمل پروتئینی بسیار محبوب و با کیفیت است که برای ورزشکاران، بدنسازان و افرادی که به دنبال افزایش مصرف پروتئین روزانه خود هستن.

گینر سوپر مس دایماتیز، یک مکمل غذایی با کالری بسیار بالا است که به طور خاص برای کمک به افرادی طراحی شده که به دنبال افزایش وزن و حجم عضلانی (Mass Gaining) هستند.

کراتین ترکیبی ناکلیر نوتریشن، یک ماتریس پیچیده است.

امگا 3 ماسل تک پلاتینیوم، ژلکپسولهایی (Softgels) هستند که هر کدام حاوی ۱۰۰۰ میلیگرم روغن ماهی خالص هستند.

پروتئین وی ایوژن ترکیبی، با نام تجاری Evofusion شناخته میشود، در واقع یک ماتریس پروتئینی پیشرفته است.

وی ایزوله مای پروتئین 1 کیلویی، در واقع خالصترین فرم پروتئین موجود در بازار را دارد.

گینر تک اکستریم ماسل تک 2.7 کیلوگرمی، یک فرمولاسیون ترکیبی ۵ در ۱ محسوب میشود.

کراتین ترکیبی ماسل اسپرت، تلاشی است برای حل بزرگترین مشکل کراتینهای قدیمی، جذب ناقص و دهیدراته شدن بدن.

وی ماسل اسپرت، مکملی با کیفیت بالا و مناسب برای افزایش توده عضلانی بدون چربی، چربیسوزی و بهبود ریکاوری است.

امگا 3 اپلاید نوتریشن، در واقع یک مکمل اسید چرب ضروری است.

I am glad to be a visitor on this website!, regards for this rare information!

کراتین هیدروکلراید، حاصل اتصال مولکول استاندارد کراتین به “هیدروکلریک اسید” است.

کراتین هیدروکلراید ماسل تک، ترکیبی از نوآوری علمی و نیاز واقعی ورزشکاران است.

I have to say this post was certainly informative and contains useful content for enthusiastic visitors. I will definitely bookmark this website for future reference and further viewing. cheers a bunch for sharing this with us!

وی ایزوله ناترند، پروتئینی که ساختار بیولوژیکیاش کاملاً حفظ شده، چربی و قند آن تقریباً به صفر رسیده.

گینر اتمیک نوکلیر، با ارائه ترکیبی هوشمندانه از ماکرونوتریینتها، به شما اجازه میدهد کالری مایع با کیفیتی را وارد بدن کنید که به سرعت جذب میشود.

Abnormal this put up is totaly unrelated to what I was searching google for, but it surely used to be listed at the first page. I suppose your doing one thing proper if Google likes you adequate to place you at the first page of a non similar search.

I want to see your book when it comes out.

گینر بی پی ای، یک فرمولاسیون ساده ولی به شدت مهندسی شده دارد.

Awesome post. It’s so good to see someone taking the time to share this information

پروتئین وی بادی بیلدر، حاوی دو نوع پروتئین کازئین (دیر جذب) و پروتئین وی (زود جذب) است.

کراتین مای پروتئین 250 گرمی، دقیقاً همان چیزی است که علم ورزش سالهاست بر آن تاکید دارد.

You certainly deserve a round of applause for your post and more specifically, your blog in general. Very high quality material!

Our local network of agencies has found your research so helpful.

کراتین اچ سی ال دنیس جیمز، محصولی پیشرفته از سری Signature، نسخهای نوین از کراتین است.

You are a very smart person! 🙂

پروتئین وی موتانت، با فرمولاسیون پیشرفته و ترکیبات دقیق، یک مکمل کامل برای حمایت از رشد عضلات و بهبود عملکرد ورزشی است.

پروتئین وی دنیس جیمز، محصولی است که با نظارت مستقیم دنیس جیمز مربی شناختهشده بدنسازی مسترالمپیا تولید میشود.

It’s the best time to make some plans for the future and it is time to be happy. I’ve read this post and if I could I wish to suggest you some interesting things or tips. Maybe you can write next articles referring to this article. I wish to read even more things about it!

whoah this weblog is great i really like studying your articles. Stay up the great work! You already know, lots of persons are looking round for this information, you can aid them greatly.

Might we expect to see more of these same problems in the future?

I encountered your site after doing a search for new contesting using Google, and decided to stick around and read more of your articles. Thanks for posting, I have your site bookmarked now.

I have been curious about these trends, and you have really helped me. I have just told a few of my friends about this on FaceBook and they love your content just as much as I do.

پروتئین وی گلد کوین لورون، تمرکز خود را بر روی کنسانتره پروتئین وی (WPC) با کیفیت بالا گذاشته است.

I absolutely adore your site! You aggressive me as able-bodied as all the others actuality and your broiled PS is absolutely great!

مس گینر ویکتور مارتینز، فلسفهای از تغذیه است که توسط خود ویکتور مارتینز طراحی شده است.

I would share your post with my sis.

Hello this is a wonderful write-up. I’m going to e mail this to my friends. I came on this while searching on yahoo I’ll be sure to come back. thanks for sharing.

مس گینر دنیس جیمز، یک مکمل ورزشی استراتژیک برای افزایش حجم عضلانی است.

Ho88 là một trong những nhà cái uy tín hàng đầu tại Việt Nam, cung cấp đa dạng các dịch vụ cá cược như thể thao, casino trực tuyến, và xổ số.

ho88 là nhà cái cá cược trực tuyến hàng đầu, cung cấp cá cược thể thao, casino, bắn cá với tỷ lệ cược cao, bảo mật tối ưu và nhiều ưu đãi hấp dẫn.

کربو رونی کلمن کیسه ای، بر پایه ایده “جذب سریع و فازبندی شده” بنا شده است.

I absolutely adore your site! You aggressive me as able-bodied as all the others actuality and your broiled PS is absolutely great!

I would really like to appreciate the endeavors you cash in on written this article. I’m going for the similar best product from you finding out in the foreseeable future as well. Actually your creative writing abilities has urged me to begin my very own blog now. Genuinely the blogging is distributing its wings rapidly. Your write down is often a fine illustration showing it.

MM88 là nền tảng cá cược hàng đầu châu Á, trải nghiệm giải trí đa dạng, bảo mật cao, giao diện thân thiện, khuyến mãi hấp dẫn và dịch vụ hỗ trợ chuyên …

of course like your web-site however you have to check the spelling on several of your posts. Many of them are rife with spelling problems and I find it very troublesome to tell the reality then again I will surely come back again.

پروتئین وی پریمیوم گلد ویکتور مارتینز، یک مکمل ورزشی پیشرفته و باکیفیت است تحت نظارت مستقیم ویکتور مارتینز.

A colleague in the field told me to check out your website.

Just came from google to your website have to say thanks.

وی دایماتیز، یک مکمل پروتئینی بسیار محبوب و با کیفیت است.

وی نیتروتک ماسل تک دارای فناوری فیلتراسیون چند فازی است.

کراتین ایس فا نوتریشن، یک پارادایم شیفت (Paradigm Shift) در مهندسی مکملها است.

پروتئین وی ایزوله وایکینگ فورس، نتیجه فرآیندهای پیچیده میکروفیلتراسیون جریان متقاطع (CFM) است.

Enjoyed studying this, very good stuff, thanks.

Great write-up, I am a big believer in placing comments on sites to inform the blog writers know that they’ve added something advantageous to the world wide web!

کراتین وایکینگ فورس، با بهرهگیری از تکنولوژیهای پیشرفته فیلتراسیون، محصولی را ارائه میدهد که ذرات آن خیلی ریز هستند.

I believe you have remarked on some very interesting points , thankyou for the post.

With internet full of dupe articles it is nice to find original content like yours thank you so very much.

This is something that will need all of our combined efforts to address.

I wanted to check up and let you know how, a great deal I cherished discovering your blog today. I might consider it an honor to work at my office and be able to utilize the tips provided on your blog and also be a part of visitors’ reviews like this. Should a position associated with guest writer become on offer at your end, make sure you let me know.

That’s some inspirational stuff. Never knew that opinions might be this varied. Thanks for all the enthusiasm to supply such helpful information here.

Kèo nhà cái bóng đá hôm nay mới nhất. Xem tỷ lệ kèo nhà cái 5 trực tuyến tối đêm nay chuẩn xác. Tỷ lệ kèo cá cược keonhacai 55 trực tiếp nhanh nhất 24h qua.

This is one very informative blog. I like the way you write and I will bookmark your blog to my favorites.

It’s the best time to make some plans for the future and it is time to be happy. I’ve read this post and if I could I wish to suggest you some interesting things or tips. Maybe you can write next articles referring to this article. I wish to read even more things about it!

گینر سریوس مس اپتیموم، یک معماری تغذیهای است که برای شرایط بحرانی کمبود وزن طراحی شده است.

Top 10 Nhà cái uy tín với dịch vụ chuyên nghiệp hàng đầu năm 2025 · 1. VIN88 · 2. ZO88 · 3. 86BET · 4. FO88 · 5. VIVU88 · 6. DOM88 · 7. SUNWIN · 8. GO88 …

کراتین مونوهیدرات الیمپ، کراتین نیتروژندار است که به طور طبیعی در کبد و کلیه سنتز میشود.

مس گینر ماسل کور، مفهوم تراکم کالری (Caloric Density) است.

Your posts provide a clear, concise description of the issues.

This is definitely a wonderful webpage, thanks a lot..

Could not disagree with the main ideas. Wonder how things will develop over the coming years.

کراتین مونوهیدرات یو اس ان، با بهرهگیری از تکنولوژیهای پیشرفته فیلتراسیون و میکرونایزیشن، ذرات کراتین را به ابعاد میکرونی خرد کرده است.

I enjoy your blog posts, saved to my bookmarks!

What’s Happening i’m new to this, I stumbled upon this I’ve found It positively useful and it has aided me out loads. I hope to contribute & help other users like its aided me. Great job.

I like your style!

There are some serious financial ramifications here.

Is it okay to put a portion of this on my weblog if perhaps I post a reference point to this web page?

مس گینر اسکال لبز، یک مکمل غذایی با دانسیته کالری بسیار بالا (High-Calorie Density) است.

کراتین رونی کلمن، یک مکمل ارگوژنیک (افزایشدهنده عملکرد) است که از ۱۰۰٪ کراتین مونوهیدرات خالص تشکیل شده است.

whoah this weblog is wonderful i like reading your articles. Keep up the good paintings! You already know, many people are looking around for this information, you can help them greatly.

Thank you, I have just been searching for information about this topic for ages and yours is the greatest I’ve discovered till now. But, what about the conclusion? Are you sure about the source?

I am glad to talk with you and you give me great help

If you don’t mind, where do you host your weblog? I am looking for a very good web host and your webpage seams to be extremely fast and up most the time…

The post is absolutely fantastic! Lots of great info and inspiration, both of which we all need! Also like to admire the time and effort you put into your website and detailed info you offer! I will bookmark your website!

Very fine blog.

This is the wave – the big wave.

کراتین بادی اتک، یکی از باکیفیتترین و معتبرترین مکملهای کراتین در سطح جهان است.

Sometimes, the sheer magnitude of the information seems overwhelming.

OK, you outline what is a big issue. But, can’t we develop more answers in the private sector?

گینر ایوژن سوپر هیوج، یکی از حرفهایترین و باکیفیتترین مکملهای افزایش وزن و حجم در دنیاست.

I saw a similar post on another website but the points were not as well articulated.

پروتئین وی بادی اتک، در هسته مرکزی خود، ترکیبی هوشمندانه از “وی کنسانتره” (Ultra-filtered Whey Concentrate) و “وی هیدرولیزه” (Hydrolyzed Whey) است.

گینر بادی اتک، ترکیبی هوشمندانه از کربوهیدراتهای پیچیده و پروتئینهای چند مرحلهای است.

I want to see your book when it comes out.

There are some serious financial ramifications here.

Nevertheless, it’s all carried out with tongues rooted solidly in cheeks, and everybody has got nothing but absolutely love for their friendly neighborhood scapegoat. In reality, he is not merely a pushover. He is simply that extraordinary breed of person solid enough to take all that good natured ribbing for what it really is.

وی ایزوله بادی اتک، یکی از باکیفیتترین و خالصترین مکملهای پروتئینی در سطح جهان است.

Thank you, I have just been searching for information about this topic for ages and yours is the greatest I’ve discovered till now. But, what about the conclusion? Are you sure about the source?

Good post. I study something more difficult on different blogs everyday. It’s going to always be stimulating to learn content material from other writers and observe a little bit one thing from their store. I’d prefer to use some with the content material on my blog whether you don’t mind. Natually I’ll give you a link in your web blog. Thanks for sharing.

You need to really control the comments listed here

کراتین پلاتینیوم ماسل تک، یکی از خالصترین و پرفروشترین مکملهای کراتین در سطح جهان است.

مس گینر کرتیکال اپلاید نوتریشن، یک فرمولاسیون فوقحرفهای است که فراتر از یک گینر معمولی برای افزایش وزن است.

Woh I enjoy your content , saved to bookmarks!

A friend of mine advised me to review this site. And yes. it has some useful pieces of info and I enjoyed reading it.

Nice Post. It’s really a very good article. I noticed all your important points. Thanks.

Makes sense to me.

We’re developing some community services to respond to this, and your blog is helpful.

I really believe you will do well in the future I appreciate everything you have added to my knowledge base.

I’ve thought about posting something about this before. Good job! Can I use part of your post in my blog?

کراتین بد اس، یک مکمل پیشرفته و قدرتمند است که برخلاف کراتینهای معمولی، ترکیب چندین نوع مختلف کراتین است.

I don’t normally comment on blogs.. But nice post! I just bookmarked your site

Hello there, just became aware of your blog through Google, and found that it is truly informative. I am going to watch out for brussels. I will appreciate if you continue this in future. Lots of people will be benefited from your writing. Cheers!

Nice post.Very useful info specifically the last part 🙂 Thank you and good luck.

Peculiar this blog is totaly unrelated to what I was searching for – – interesting to see you’re well indexed in the search engines.

I Am Going To have to come back again when my course load lets up – however I am taking your Rss feed so i can go through your site offline. Thanks.

Thank you for this great piece of content. Best Regards

I think other website proprietors should take this web site as an model, very clean and great user pleasant style and design .

fantastic internet site, I could definitely go to your web page once more…acquired some really nice info.

Just a quick note to express my appreciation. Take care

Advanced reading here!

Amazing! Your site has quite a few comment posts. How did you get all of these bloggers to look at your site I’m envious! I’m still studying all about posting articles on the net. I’m going to view pages on your website to get a better understanding how to attract more people. Thank you!

How long have you been in this field? You seem to know a lot more than I do, I’d love to know your sources!

This is really interesting, You’re a very skilled blogger. I have joined your feed and look forward to seeking more of your fantastic post. Also, I have shared your website in my social networks!

I absolutely adore your site! You aggressive me as able-bodied as all the others actuality and your broiled PS is absolutely great!

I loved your idea there, I tell you blogs are so exciting sometimes like looking into people’s private life’s and work. Every new remark wonderful in its own right.

Certainly. And I have faced it. Let’s discuss this question. Here or in PM.

Hey! awesome blog! I happen to be a daily visitor to your site (somewhat more like addict 😛 ) of this website. Just wanted to say I appreciate your blogs and am looking forward for more!

I love what you’ve created here, this is definitely one of my favorite sites to visit.

You need to really control the comments listed here

Hello there, just became aware of your blog through Google, and found that it is truly informative. I am going to watch out for brussels. I will appreciate if you continue this in future. Lots of people will be benefited from your writing. Cheers!

I simply could not leave your site before suggesting that I actually enjoyed the usual info a person supply in your visitors? Is going to be back often to inspect new posts

A friend of mine advised me to review this site. And yes. it has some useful pieces of info and I enjoyed reading it.

Could not disagree with the main ideas. Wonder how things will develop over the coming years.

I want to see your book when it comes out.

I would really like to appreciate the endeavors you cash in on written this article. I’m going for the similar best product from you finding out in the foreseeable future as well. Actually your creative writing abilities has urged me to begin my very own blog now. Genuinely the blogging is distributing its wings rapidly. Your write down is often a fine illustration showing it.

fantastic post, very informative. I wonder why more of the ther experts in the field do not break it down like this. You should continue your writing. I am confident, you have a great readers’ base already!

have already been reading ur blog for a couple of days. really enjoy what you posted. btw i will be doing a report about this topic. do you happen to know any great websites or forums that I can find out more? thanks a lot.

Lovely just what I was looking for. Thanks to the author for taking his clock time on this one.

Abnormal this put up is totaly unrelated to what I was searching google for, but it surely used to be listed at the first page. I suppose your doing one thing proper if Google likes you adequate to place you at the first page of a non similar search.

Nice Post. It’s really a very good article. I noticed all your important points. Thanks.

There most be a solution for this problem, some people think there will be now solutions, but i think there wil be one.

Good day! This is my first comment here so I just wanted to give a quick shout out and say I really enjoy reading through your articles. Can you recommend any other blogs/websites/forums that cover the same subjects? Thanks a lot!

I love your blog. It looks every informative.

I value the useful analytics and stable performance. This site is reliable.

Hello there, You have done an incredible job. I will certainly digg it and personally recommend to my friends. I am sure they will be benefited from this site.

Unquestionably believe that which you said. Your favorite reason seemed to be on the net the easiest thing to be aware of. I say to you, I certainly get annoyed while people consider worries that they plainly don’t know about. You managed to hit the nail on the head. Will probably be back to get more. Thanks

Makes sense to me.

You certainly deserve a round of applause for your post and more specifically, your blog in general. Very high quality material!

It’s time for communities to rally.

I personally find that i value the reliable uptime and accurate charts. This site is reliable. The mobile app makes daily use simple.

Amazing! Your site has quite a few comment posts. How did you get all of these bloggers to look at your site I’m envious! I’m still studying all about posting articles on the net. I’m going to view pages on your website to get a better understanding how to attract more people. Thank you!

Keep it up!. I usually don’t post in Blogs but your blog forced me to, amazing work.. beautiful A rise in An increase in An increase in.

I have to disagree with most of the comments here, but maybe I’m just a contrarian.

Good post. I study something more difficult on different blogs everyday. It’s going to always be stimulating to learn content material from other writers and observe a little bit one thing from their store. I’d prefer to use some with the content material on my blog whether you don’t mind. Natually I’ll give you a link in your web blog. Thanks for sharing.

This contained some excellent tips and tools. Great blog publication.

I wish I could craft such articles as this. Thank you very much.

Its wonderful as your other blog posts : D, regards for putting up.

Well, I don’t know if that’s going to work for me, but definitely worked for you! 🙂 Excellent post!

I love your blog.. very nice colors & theme. Did you design this website yourself or did you hire someone to

do it for you? Plz reply as I’m looking to construct my

own blog and would like to know where u got this from.

kudos

Its like you read my mind! You appear to know so much about this, like you wrote the book in it or something.

I think that you can do with a few pics to drive the message home a little bit, but instead of that, this is excellent blog.

A fantastic read. I will definitely be back.

Hi there i am kavin, its my first time to commenting anyplace, when i read this piece of writing i thought

i could also make comment due to this sensible article.

پروتئین وی امپایر وایکینگ فورس، ریشه در سوئد دارد، کشوری که استانداردهای کنترل کیفیتش در صنایع غذایی و مکمل، زبانزد عام و خاص است.

Everything is very open with a really clear description of the issues.

It was really informative. Your website is extremely helpful.

Many thanks for sharing!

پروتئین وی بد اس، یک مکمل پروتئینی با کیفیت بالا است که از شیر بهدست میآید

مولتی ویتامین پلاتینیوم ماسل تک، یک مکمل غذایی باکیفیت است که به طور خاص برای ورزشکاران و افرادی که به دنبال بهبود عملکرد ورزشی خود هستند طراحی شده است.

Hey very cool site!! Man .. Beautiful .. Amazing .. I will bookmark your website and take the feeds also…I’m happy to find so many useful information here in the post, we need develop more strategies in this regard, thanks for sharing. . . . . .

Lovely just what I was looking for. Thanks to the author for taking his clock time on this one.

My brother suggested I might like this web site. He was entirely right. This post actually made my day. You can not imagine simply how much time I had spent for this info! Thanks!

Nice Post. It’s really a very good article. I noticed all your important points. Thanks.

I like meeting utile info, this post has got me even more info!

While this issue can vexed most people, my thought is that there has to be a middle or common ground that we all can find. I do value that you’ve added pertinent and sound commentary here though. Thank you!

Hello there, just became aware of your blog through Google, and found that it is truly informative. I am going to watch out for brussels. I will appreciate if you continue this in future. Lots of people will be benefited from your writing. Cheers!

I’ve been surfing online more than 3 hours today, yet I never found any interesting article like yours. It’s pretty worth enough for me. In my view, if all web owners and bloggers made good content as you did, the net will be much more useful than ever before.

I would share your post with my sis.

I dont think I’ve read anything like this before. So good to find somebody with some original thoughts on this subject. cheers for starting this up. This blog is something that is needed on the web, someone with a little originality.

I am glad to talk with you and you give me great help

This is a great blog. Thank you for the very informative post.

Took me time to read all the comments, but I really enjoyed the article. It proved to be Very helpful to me and I am sure to all the commenters here It’s always nice when you can not only be informed, but also entertained I’m sure you had fun writing this article.

Are the issues really as complex as they seem?

I would really like to appreciate the endeavors you cash in on written this article. I’m going for the similar best product from you finding out in the foreseeable future as well. Actually your creative writing abilities has urged me to begin my very own blog now. Genuinely the blogging is distributing its wings rapidly. Your write down is often a fine illustration showing it.

پروتئین وی گالوانایز، یک مکمل غذایی محبوب در بین ورزشکاران و افرادی است که به دنبال افزایش مصرف پروتئین خود هستند.

کراتین مونوهیدرات گالوانایز، یکی از محبوبترین و مورد مطالعهترین مکملهای ورزشی در جهان است.

I’m impressed, I need to say. Really rarely do I encounter a blog that’s both educational and entertaining, and let me tell you, you have hit the nail on the head.

Good points – – it will make a difference with my parents.

Woah this is just an insane amount of information, must of taken ages to compile so thanx so much for just sharing it with all of us. If your ever in any need of related information, just check out my own site!

Peculiar this blog is totaly unrelated to what I was searching for – – interesting to see you’re well indexed in the search engines.

This information is critically needed, thanks.

مس گینر گالوانایز، یکی از بهترین گزینههای شماست اگر دنبال یک مکمل قوی برای افزایش میزان ماسه و تقویت عضلات هستید.

What made you first develop an interest in this topic?

Woah this is just an insane amount of information, must of taken ages to compile so thanx so much for just sharing it with all of us. If your ever in any need of related information, just check out my own site!

مس گینر بد اس، یک مکمل غذایی قدرتمند است که به طور خاص برای ورزشکاران و افرادی که به دنبال افزایش حجم عضلانی و قدرت بدنی هستند، طراحی شده است.

I have to say this post was certainly informative and contains useful content for enthusiastic visitors. I will definitely bookmark this website for future reference and further viewing. cheers a bunch for sharing this with us!

Nice piece of info! May I reference part of this on my blog if I post a backlink to this webpage? Thx.

مس گینر روولوشن ماسل اسپرت، یک سیستم کامل برای افزایش کالری دریافتی و پشتیبانی از ریکاوری عضلانی است.

My brother suggested I might like this web site. He was entirely right. This post actually made my day. You can not imagine simply how much time I had spent for this info! Thanks!

Nice piece of info! May I reference part of this on my blog if I post a backlink to this webpage? Thx.

I’ve been active for several months, mostly for learning crypto basics, and it’s always wide token selection.

OK, you outline what is a big issue. But, can’t we develop more answers in the private sector?

That is really fascinating, You’re an excessively skilled blogger. I’ve joined your rss feed and look forward to in the hunt for extra of your magnificent post. Additionally, I’ve shared your website in my social networks!

The sketch is tasteful, your authored material stylish.

This is an awesome entry. Thank you very much for the supreme post provided! I was looking for this entry for a long time, but I wasn’t able to find a honest source.

Clear, concise and easy to access.

Magnificent beat ! Can I be your apprentice? Just kidding!

Well, I don’t know if that’s going to work for me, but definitely worked for you! 🙂 Excellent post!

I absolutely adore your site! You aggressive me as able-bodied as all the others actuality and your broiled PS is absolutely great!

Admiring the time and effort you put into your site and detailed info you offer!

The transparency around accurate charts is refreshing and builds trust. The updates are frequent and clear.

وی ایزوله ماسل کور، قلهی تکنولوژی فرآوری پروتئین وی است.

What i discover troublesome is to find a weblog that may capture me for a minute however your blog is different. Bravo.

Thanks pertaining to discussing the following superb written content on your site. I ran into it on the search engines. I will check back again if you publish extra aricles.

I like the helpful information you provide in your articles. I’ll bookmark your blog and check again here frequently. I am quite certain I’ll learn many new stuff right here! Best of luck for the next!

I just couldnt leave your website before saying that I really enjoyed the useful information you offer to your visitors… Will be back often to check up on new stuff you post!

Aw, this was a very nice post. In idea I wish to put in writing like this moreover taking time and precise effort to make an excellent article! I procrastinate alot and by no means seem to get something done.

I cannot thank you more than enough for the blogposts on your website. I know you set a lot of time and energy into these and truly hope you know how deeply I appreciate it. I hope I’ll do a similar thing person sooner or later.

Nevertheless, it’s all carried out with tongues rooted solidly in cheeks, and everybody has got nothing but absolutely love for their friendly neighborhood scapegoat. In reality, he is not merely a pushover. He is simply that extraordinary breed of person solid enough to take all that good natured ribbing for what it really is.

This will be helpful for my family.

Hello there, You have done an incredible job. I will certainly digg it and personally recommend to my friends. I am sure they will be benefited from this site.

I personally find that the site is easy to use and the useful analytics keeps me coming back.

hey thanks for the info. appreciate the good work

وی الایت دایماتیز، یک پروتئین ترکیبی هوشمند است.

We can see that we need to develop policies to deal with this trend.

Do you offer workshops?

Glad to be one of several visitors on this awful internet site : D.

کراتین بلید اسپورت، با درجه خلوص دارویی تولید میشود.

I am glad to be one of the visitors on this great site (:, appreciate it for putting up.

This will be helpful for my family.

I’ve thought about posting something about this before. Good job! Can I use part of your post in my blog?

You are a very smart person! 🙂

This is valuable stuff.In my opinion, if all website owners and bloggers developed their content they way you have, the internet will be a lot more useful than ever before.

I’m so happy to read this. This is the type of manual that needs to be given and not the random misinformation that’s at the other blogs. Appreciate your sharing this best doc.

I appreciate your work, thanks for all the great blog posts.

Greetings! This is my first visit to your blog! We are a collection of volunteers and starting a new initiative in a community in the same niche. Your blog provided us beneficial information. You have done a wonderful job!

Howdy, a helpful article for sure. Thank you.

Saw your material, and hope you publish more soon.

Clear, concise and easy to access.

I believe you have remarked on some very interesting points , thankyou for the post.

Are the issues really as complex as they seem?

When we look at these issues, we know that they are the key ones for our time.

Excellent read, I just passed this onto a colleague who was doing a little research on that. And he actually bought me lunch because I found it for him smile So let me rephrase that.|

have already been reading ur blog for a couple of days. really enjoy what you posted. btw i will be doing a report about this topic. do you happen to know any great websites or forums that I can find out more? thanks a lot.

A thoughtful insight and ideas I will use on my blog. You’ve obviously spent some time on this. Congratulations

Sometimes, the sheer magnitude of the information seems overwhelming.

Hi there, just became aware of your blog through Google, and found that it’s truly informative. It’s important to cover these trends.

Good job for bringing something important to the internet!

How long does it take you to write an article like this?

If wings are your thing, Tinker Bell’s sexy Halloween costume design is all grown up.

Pretty nice post. I just stumbled upon your weblog and wanted to say that I’ve really enjoyed surfing around your blog posts. After all I’ll be subscribing in your feed and I am hoping you write again very soon!

Hi there! I just wanted to ask if you ever have any trouble with hackers? My last blog (wordpress) was hacked and I ended up losing several weeks of hard work due to no back up. Do you have any solutions to protect against hackers?

Hi there! I just wanted to ask if you ever have any trouble with hackers? My last blog (wordpress) was hacked and I ended up losing several weeks of hard work due to no back up. Do you have any solutions to protect against hackers?

Our family had similar issues, thanks.

A wholly agreeable point of view, I think primarily based on my own experience with this that your points are well made, and your analysis on target.

Your posts provide a clear, concise description of the issues.

When are you going to post again? You really entertain me!

Public policy is key here, and our states need to develop some strategies – – soon.

I like your blog. It sounds every informative.

I imagine so. Very good stuff, I agree totally.

پروتئین وی بلید اسپرت، به دلیل سرعت جذب بالا و پروفایل کامل آمینو اسیدی، پادشاه پروتئینها لقب گرفته است.

Thank you for all the information was very accurate, just wondering if all this is possible.~

The post is absolutely great! Lots of great info and inspiration, both of which we all need! Also like to admire the time and effort you put into your blog and detailed information you offer! I will bookmark your website!

WoW decent article. Can I hire you to guest write for my blog? If so send me an email!

Could not disagree with the main ideas. Wonder how things will develop over the coming years.

The post is absolutely fantastic! Lots of great info and inspiration, both of which we all need! Also like to admire the time and effort you put into your website and detailed info you offer! I will bookmark your website!

Very fine blog.

وی ایزوله بلید اسپرت، محصول کمپانی Blade Sport مجارستان است که با استفاده از تکنولوژیهای پیشرفته فیلتراسیون تولید شده است.

Great platform with useful analytics — it made my crypto journey easier. Perfect for both new and experienced traders.

کراتین هیدروکلراید کیجد، یک فرم پیشرفته و مهندسیشده از مکمل کراتین است.

Simply want to say your article is as amazing. The clarity in your post is just great and i can assume you’re an expert on this subject. Fine with your permission allow me to grab your feed to keep up to date with forthcoming post. Thanks a million and please keep up the gratifying work.

Hello, I think your blog might be having browser compatibility issues. When I look at your website in Chrome, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other than that, awesome blog!

Does it look like we’re in for a big ride here?

Have you always been concerned about these issues?

My brother suggested I might like this websiteHe was once totally rightThis post truly made my dayYou can not imagine simply how a lot time I had spent for this information! Thanks!

Hello this is kinda of off topic but I was wondering if blogs use WYSIWYG editors or if you have to manually code with HTML. I’m starting a blog soon but have no coding knowledge so I wanted to get advice from someone with experience. Any help would be enormously appreciated!

There most be a solution for this problem, some people think there will be now solutions, but i think there wil be one.

Nevertheless, it’s all carried out with tongues rooted solidly in cheeks, and everybody has got nothing but absolutely love for their friendly neighborhood scapegoat. In reality, he is not merely a pushover. He is simply that extraordinary breed of person solid enough to take all that good natured ribbing for what it really is.

I personally find that i’ve been using it for a week for portfolio tracking, and the reliable uptime stands out.

مس گینر ماسل مکس بلید اسپرت، یک مکمل افزایش وزن و حجمدهنده پیشرفته با فرمولاسیون اروپایی (ساخت مجارستان) است.

Can I just say what a relief to seek out someone who actually knows what theyre speaking about on the internet. You positively know find out how to bring a problem to mild and make it important. Extra individuals have to read this and perceive this side of the story. I cant believe youre not more in style because you positively have the gift.

With this issue, it’s important to have someone like you with something to say that really matters.

Wish I’d thought of this. Am in the field, but I procrastinate alot and haven’t written as much as I’d like. Thanks.

I just couldn’t leave your website before suggesting that I really enjoyed the usual information an individual supply on your visitors? Is gonna be back often in order to investigate cross-check new posts

I’ll check back after you publish more articles.

Thank you for this great piece of content. Best Regards

Excellent article!! I am an avid reader of your website:D keep on posting that good content. and I’ll be a regular visitor for a very long time!!

Lovely just what I was looking for. Thanks to the author for taking his clock time on this one.

Hey! awesome blog! I happen to be a daily visitor to your site (somewhat more like addict 😛 ) of this website. Just wanted to say I appreciate your blogs and am looking forward for more!

Amazing! Your site has quite a few comment posts. How did you get all of these bloggers to look at your site I’m envious! I’m still studying all about posting articles on the net. I’m going to view pages on your website to get a better understanding how to attract more people. Thank you!

We can see that we need to develop policies to deal with this trend.

Lovely just what I was looking for. Thanks to the author for taking his clock time on this one.

Howdy I wanted to write a new remark on this page for you to be able to tell you just how much i actually Enjoyed reading this read. I have to run off to work but want to leave ya a simple comment. I saved you So will be returning following work in order to go through more of yer quality posts. Keep up the good work.

This is one very informative blog. I like the way you write and I will bookmark your blog to my favorites.

I do believe your audience could very well want a good deal more stories like this carry on the excellent hard work.

Woah this is just an insane amount of information, must of taken ages to compile so thanx so much for just sharing it with all of us. If your ever in any need of related information, just check out my own site!

There most be a solution for this problem, some people think there will be now solutions, but i think there wil be one.

My coder is trying to convince me to move to .net from PHP. I have always disliked the idea because of the expenses. But he’s tryiong none the less. I’ve been using WordPress on numerous websites for about a year and am nervous about switching to another platform. I have heard great things about blogengine.net. Is there a way I can import all my wordpress posts into it? Any help would be really appreciated!

I personally find that this platform exceeded my expectations with low fees and trustworthy service. The mobile app makes daily use simple.

Fantastic piece of writing here1

When we look at these issues, we know that they are the key ones for our time.

We absolutely love your blog and find the majority of your post’s to be exactly what I’m looking for. Do you offer guest writers to write content to suit your needs? I wouldn’t mind composing a post or elaborating on a number of the subjects you write about here. Again, awesome weblog!

If most people wrote about this subject with the eloquence that you just did, I’m sure people would do much more than just read, they act. Great stuff here. Please keep it up.

I just sent this post to a bunch of my friends as I agree with most of what you’re saying here and the way you’ve presented it is awesome.

I like your quality that you put into your writing . Please do continue with more like this.

Zespół ARMIA powstał w 1984 roku na skutek zetknięcia trzech osobowości naszej niezależnej sceny: Tomasza Budzyńskiego (Siekiera), Roberta Brylewskiego ( Brygada Kryzys , Izrael) i filozofa Sławomira Gołaszewskiego.

Zespół wydał kilkanaście płyt, z których wydana w 1990 roku „Legenda” oraz „Triodante” z 1994 r. zaliczane są do klasyki polskiej muzyki rockowej. W ciągu trzydziestokilkuletniej kariery zespołu w jego składzie grało wielu wybitnych i zasłużonych dla rockowej sceny muzyków. W 2011 roku na Międzynarodowym Festiwalu Filmowym Howe Horyzonty we Wrocławiu miał premierę film „Podróż na Wschód”, który jest poetycką historią zespołu Armia opartą na kanwie opowiadania Stefana Grabińskiego. Jest on dołączony w formie DVD do autobiograficznej książki Tomasza Budzyńskiego „Soul Side Story

It’s time for communities to rally.

Sometimes, the sheer magnitude of the information seems overwhelming.

Nasz portal został stworzony specjalnie dla polskich graczy, którzy szukają rzetelnych informacji o polskie kasyno online. Testujemy i analizujemy polskie kasyna online, które działają na rynku europejskim i akceptują graczy z Polski. Każde polskie kasyno, które opisujemy, przechodzi przez nasz autorski proces weryfikacji – sprawdzamy licencję, ofertę gier, metody płatności, dostępność w języku polskim i zgodność z oczekiwaniami polskich graczy.

Przejrzyj nasz aktualny ranking i przeczytaj szczegółowe opisy, aby dowiedzieć się, gdzie znaleźć najlepsze bonusy bez depozytu na luty 2026 roku. Wyjaśniamy, na czym polega bonus bez depozytu, jak otrzymać darmowe środki lub spiny, oraz które oferty są naprawdę warte uwagi! Serwisy hazardowe proponują atrakcyjne bonusy bez depozytu za rejestrację. Przeanalizowaliśmy rynek, sprawdzając, które polskie kasyno online oferuje najkorzystniejsze warunki dla nowych graczy. Prezentujemy najlepsze oferty bonusów bez depozytu na luty 2026, w tym propozycje od NV Casino oraz Roman Casino.

I’ve been active for almost a year, mostly for cross-chain transfers, and it’s always wide token selection.

کراتین مونوهیدرات موتانت، یکی از خالصترین و باکیفیتترین مکملهای افزایش قدرت و حجم در دنیاست.

OK, you outline what is a big issue. But, can’t we develop more answers in the private sector?

وی ایزوله اپتیموم نوتریشن، را میتوان استاندارد طلایی و مهندسیشدهترین فرم پروتئین وی دانست.

This information is very important and you’ll need to know this when you constructor your own photo voltaic panel.

I personally find that i’ve been active for a week, mostly for using the bridge, and it’s always great support. I moved funds across chains without a problem.

Great post. Just a heads up – I am running Ubuntu with the beta of Firefox and the navigation of your blog is kind of broken for me.

I had fun reading this post. I want to see more on this subject.. Gives Thanks for writing this nice article.. Anyway, I’m going to subscribe to your rss and I wish you write great articles again soon.

Great post, keep up the good work, I hope you don’t mind but I’ve added on my blog roll.

The start of a fast-growing trend?

Beneficial Blog! I had been simply just debating that there are plenty of screwy results at this issue you now purely replaced my personal belief. Thank you an excellent write-up.

پروتئین وی ایزوله آلمکس، نماینده نسل جدیدی از پروتئینهاست.

Greetings, have tried to subscribe to this websites rss feed but I am having a bit of a problem. Can anyone kindly tell me what to do?’

Excellent read, I just passed this onto a colleague who was doing a little research on that. And he actually bought me lunch because I found it for him smile So let me rephrase that.|

The sketch is tasteful, your authored material stylish.

Spot on with this write-up, I truly believe this website requirements a lot much more consideration. I’ll probably be once more to read much much more, thanks for that info.

وی بادی بیلدینگ، یک مکمل پروتئینی ترکیبی و خوشنام است.

Nevertheless, it’s all carried out with tongues rooted solidly in cheeks, and everybody has got nothing but absolutely love for their friendly neighborhood scapegoat. In reality, he is not merely a pushover. He is simply that extraordinary breed of person solid enough to take all that good natured ribbing for what it really is.

Europe Readr ist mehr als nur eine digitale Bibliothek – es ist ein kulturelles und demokratisches Projekt, das Literatur, Bildung und gesellschaftliches Engagement miteinander verbindet. Initiiert im Rahmen der slowenischen EU-Ratspräsidentschaft im Jahr 2021, bietet Europe Readr eine kostenlose, mehrsprachige Sammlung literarischer Werke aus ganz Europa, die aktuelle gesellschaftliche Themen aufgreifen und zur aktiven Auseinandersetzung anregen.

WoW decent article. Can I hire you to guest write for my blog? If so send me an email!

Thanks for your patience and sorry for the inconvenience!

Pretty impressive article. I just stumbled upon your site and wanted to say that I have really enjoyed reading your opinions. Any way I’ll be coming back and I hope you post again soon.

Thanks so much for this, keep up the good work 🙂

کراتین ناترند، با بالاترین استانداردهای کیفی اروپا تولید شده و خلوص آن تضمین شده است.

I appreciate your work, thanks for all the great blog posts.

Our communities really need to deal with this.

Oh my goodness! an amazing article. Great work.

What’s Happening i’m new to this, I stumbled upon this I’ve found It positively useful and it has aided me out loads. I hope to contribute & help other users like its aided me. Great job.

Loving the info on this website , you have done outstanding job on the blog posts.

Peculiar this blog is totaly unrelated to what I was searching for – – interesting to see you’re well indexed in the search engines.

I can’t go into details, but I have to say its a good article!

My brother suggested I might like this web site. He was entirely right. This post actually made my day. You can not imagine simply how much time I had spent for this info! Thanks!

I feel that is among the so much significant info for me. And i am satisfied studying your article. However should commentary on some basic issues, The site style is ideal, the articles is in reality excellent : D. Excellent activity, cheers

I like your style!

of course like your web-site however you have to check the spelling on several of your posts. Many of them are rife with spelling problems and I find it very troublesome to tell the reality then again I will surely come back again.

That’s some inspirational stuff. Never knew that opinions might be this varied. Thanks for all the enthusiasm to supply such helpful information here.

مس گینر ناترکس، در واقع یک فرمولاسیون پیشرفته و یک بمب کالری مهندسیشده است.

I feel that is among the so much significant info for me. And i am satisfied studying your article. However should commentary on some basic issues, The site style is ideal, the articles is in reality excellent : D. Excellent activity, cheers

Took me time to read the material, but I truly loved the article. It turned out to be very useful to me.

Thanks , I’ve recently been searching for info about this topic for ages and yours is the best I have discovered so far. But, what concerning the bottom line? Are you certain concerning the source?

Thanks a bunch for sharing this with all people you really recognize what you are talking about! Bookmarked. Kindly also seek advice from my web site =). We can have a link alternate contract between us!

I’ve read several good stuff here. Definitely worth bookmarking for revisiting. I surprise how much effort you put to make such a magnificent informative site.

I am glad to be a visitor of this thoroughgoing web blog ! , regards for this rare information! .

I think it is a nice point of view. I most often meet people who rather say what they suppose others want to hear. Good and well written! I will come back to your site for sure!

I had fun reading this post. I want to see more on this subject.. Gives Thanks for writing this nice article.. Anyway, I’m going to subscribe to your rss and I wish you write great articles again soon.

This has to be one of my favorite posts! And on top of thats its also very helpful topic for newbies. thank a lot for the information!

Enjoyed studying this, very good stuff, thanks.

I can’t go into details, but I have to say its a good article!

Hello this is a wonderful write-up. I’m going to e mail this to my friends. I came on this while searching on yahoo I’ll be sure to come back. thanks for sharing.

you’re in reality a just right webmaster. The web site loading velocity is incredible. It sort of feels that you’re doing any distinctive trick. In addition, The contents are masterpiece. you’ve performed a great process on this topic!

You certainly deserve a round of applause for your post and more specifically, your blog in general. Very high quality material!

I like to spend my free time by scaning various internet recourses. Today I came across your site and I found it is as one of the best free resources available! Well done! Keep on this quality!

I have to disagree with most of the comments here, but maybe I’m just a contrarian.

Just want to say what a great blog you got here!I’ve been around for quite a lot of time, but finally decided to show my appreciation of your work!

Nice post.Very useful info specifically the last part 🙂 Thank you and good luck.

I encountered your site after doing a search for new contesting using Google, and decided to stick around and read more of your articles. Thanks for posting, I have your site bookmarked now.

Slottica PL zaprasza Cię do świata pełnego emocji i wyjątkowych możliwości wygranej. Nasza platforma, oferująca bonus 25 zł na start bez depozytu, stała się wyborem numer jeden wśród polskich graczy. Według badań przeprowadzonych na próbie ponad 6000 użytkowników, Slottica jest liderem w dostarczaniu najlepszych automatów w Polsce. W naszej bibliotece znajdziesz popularne tytuły, takie jak Fire Joker, Crazy Time, Book of Dead oraz Energy Joker: Hold and Win. Od momentu założenia w 2019 roku zaufało nam już ponad 350 tysięcy graczy. Nasza działalność opiera się na licencji wydanej przez władze Curacao, co gwarantuje pełną zgodność z regulacjami obowiązującymi w Polsce i Europie. Nasz cel? Być realną alternatywą dla Total Casino, oferując lepsze gry i wyższą jakość usług.

There most be a solution for this problem, some people think there will be now solutions, but i think there wil be one.

Nevertheless, it’s all carried out with tongues rooted solidly in cheeks, and everybody has got nothing but absolutely love for their friendly neighborhood scapegoat. In reality, he is not merely a pushover. He is simply that extraordinary breed of person solid enough to take all that good natured ribbing for what it really is.

This is the wave – the big wave.

Substantially, the post is really the best on this laudable topic. I concur with your conclusions and will eagerly watch forward to your future updates.Just saying thanx will not just be enough, for the wonderful lucidity in your writing.

Nice blog. Could someone with little experience do it, and add updates without messing it up? Good information on here, very informative.

The interface is stable performance, and I enjoy learning crypto basics here.

thank, I thoroughly enjoyed reading your article. I really appreciate your wonderful knowledge and the time you put into educating the rest of us.

This is an awesome entry. Thank you very much for the supreme post provided! I was looking for this entry for a long time, but I wasn’t able to find a honest source.

Our family had similar issues, thanks.

I personally find that i’ve been active for a year, mostly for using the API, and it’s always responsive team.

Some truly interesting info , well written and broadly user genial .

Thanks for some other great post. Where else may anybody get that kind of information in such an ideal method of writing? I’ve a presentation next week, and I am at the look for such information.

I love what you’ve created here, this is definitely one of my favorite sites to visit.

We are a group of volunteers and starting a new initiative in our community. Your blog provided us with valuable information to work on|.You have done a marvellous job!

You need to really control the comments listed here

I saw a similar post on another website but the points were not as well articulated.

I’ve been surfing online more than 3 hours today, yet I never found any interesting article like yours. It’s pretty worth enough for me. In my view, if all web owners and bloggers made good content as you did, the net will be much more useful than ever before.

We’re developing a conference, and it looks like you would be a great speaker.

I think other website proprietors should take this web site as an model, very clean and great user pleasant style and design .

Do you offer workshops?

I’ll check back after you publish more articles.

Slotica to dynamiczne kasyno w internecie, które zdobyło uznanie graczy w Polsce oraz poza jej granicami. Dzięki swoim unikalnym zaletom jest doskonałym wyborem zarówno dla początkujących, jak i doświadczonych entuzjastów gier hazardowych. Jednym z największych atutów platformy jest pełna obsługa w języku polskim, co ułatwia grę zarówno osobom z Polski, jak i Polakom mieszkającym w Niemczech czy Holandii.Jednym z wyróżników kasyna jest brak konieczności weryfikacji konta, co umożliwia natychmiastowe rozpoczęcie gry. Ekspresowe wypłaty wygranych oraz obsługa popularnych metod płatności, takich jak Revolut, czynią korzystanie z platformy wyjątkowo wygodnym. Co więcej, kasyno akceptuje płatności w polskiej walucie, oferując stawki zaczynające się już od 1 grosza – dzięki temu każdy gracz znajdzie tu coś dla siebie, niezależnie od budżetu.

Nice read, I just passed this onto a colleague who was doing some research on that. And he just bought me lunch as I found it for him smile Therefore let me rephrase that: Thank you for lunch!

I personally find that the interface is useful analytics, and I enjoy learning crypto basics here. The dashboard gives a complete view of my holdings.

Platforma Slottica to miejsce, w którym pasja do hazardu spotyka się z technologią najwyższej klasy. Od momentu uruchomienia w 2019 roku kierujemy się zasadami fair play, ochrony danych osobowych oraz ciągłego rozwoju oferty. Posiadamy ważną licencję międzynarodową Curaçao eGaming (nr 8048/JAZ2018-040), co potwierdza naszą wiarygodność i zgodność z regulacjami branżowymi. Tysiące aktywnych użytkowników z Polski wybiera nas każdego dnia.

I value the intuitive UI and seamless withdrawals. This site is reliable.

I like to spend my free time by scaning various internet recourses. Today I came across your site and I found it is as one of the best free resources available! Well done! Keep on this quality!

Wow, amazing blog layout! How long have you been blogging for? you made blogging look easy. The overall look of your site is great, as well as the content!

Developing a framework is important.

I switched from another service because of the fast transactions and useful analytics.

I personally find that riley here — I’ve tried swapping tokens and the clear transparency impressed me. Perfect for both new and experienced traders.

I personally find that the checking analytics process is simple and the fast transactions makes it even better.

https://www.npmjs.com/package/nudify-ai

That is really fascinating, You’re an excessively skilled blogger. I’ve joined your rss feed and look forward to in the hunt for extra of your magnificent post. Additionally, I’ve shared your website in my social networks!

I just added your web site to my blogroll, I hope you would look at doing the same.

While this issue can vexed most people, my thought is that there has to be a middle or common ground that we all can find. I do value that you’ve added pertinent and sound commentary here though. Thank you!

Hi, possibly i’m being a little off topic here, but I was browsing your site and it looks stimulating. I’m writing a blog and trying to make it look neat, but everytime I touch it I mess something up. Did you design the blog yourself?

Great post, keep up the good work, I hope you don’t mind but I’ve added on my blog roll.

I’ve read several good stuff here. Definitely worth bookmarking for revisiting. I surprise how much effort you put to make such a magnificent informative site.