Despite the announcement, Metaplanet’s stock fell 4.24% on the Tokyo Stock Exchange on Friday, closing at 3,610 yen.

Japanese investment firm MetaPlanet Inc. has raised 9.5 billion yen (approximately $60.6 million) this week through two bond issuances to accelerate its Bitcoin purchases. The Tokyo-listed company, which announced plans earlier this year to adopt Bitcoin as a key treasury reserve asset, is speeding up its strategy to invest in the cryptocurrency.

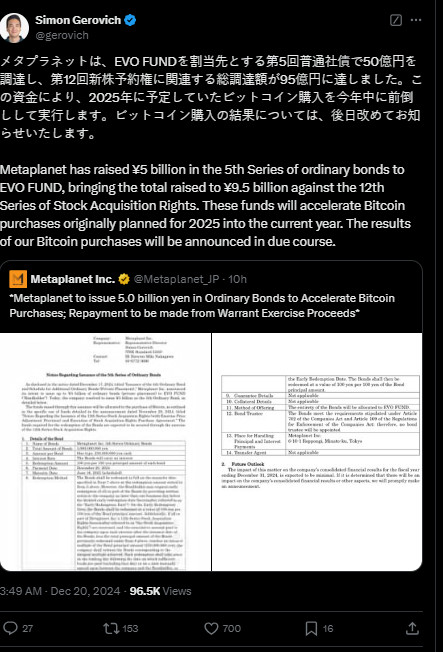

Metaplanet issued a 5 billion yen ($31.9 million) bond on Friday, following a 4.5 billion yen ($28.7 million) bond issuance earlier this week. Both bonds are set to mature on June 16, 2025, and notably, neither carries interest.

https://twitter.com/gerovich/status/1869922958720012294

Japanese investment firm MetaPlanet Inc. has raised 9.5 billion yen (approximately $60.6 million) this week through two bond issuances to accelerate its Bitcoin purchases. The Tokyo-listed company, which announced plans earlier this year to adopt Bitcoin as a key treasury reserve asset, is speeding up its strategy to invest in the cryptocurrency.

Metaplanet issued a 5 billion yen ($31.9 million) bond on Friday, following a 4.5 billion yen ($28.7 million) bond issuance earlier this week. Both bonds are set to mature on June 16, 2025, and notably, neither carries interest.

メタプラネットは、EVO FUNDを割当先とする第5回普通社債で50億円を調達し、第12回新株予約権に関連する総調達額が95億円に達しました。この資金により、2025年に予定していたビットコイン購入を今年中に前倒しして実行します。ビットコイン購入の結果については、後日改めてお知らせいたします。… https://t.co/RLw3ADFNRr— Simon Gerovich (@gerovich) December 20, 2024

“These funds will bring forward Bitcoin purchases originally planned for 2025 into the current year,” CEO Simon Gerovich said in a statement shared on social media platform X.

The company has been on a Bitcoin buying spree since its May announcement to prioritize the cryptocurrency as part of its financial strategy. As of December 18, Metaplanet held approximately 1,142 BTC, valued at around $110.3 million based on current market prices.

Despite the announcement, Metaplanet’s stock fell 4.24% on the Tokyo Stock Exchange on Friday, closing at 3,610 yen. However, the company’s stock has surged an impressive 2,023% since the start of the year. On Thursday, Metaplanet shares also began trading in the U.S. OTCQX market, where they closed nearly 10% lower on their first trading day.

While Metaplanet’s Bitcoin holdings continue to grow, U.S.-based MicroStrategy remains the largest public corporate holder of Bitcoin, owning 439,000 BTC, according to data from Bitcoin Treasury.