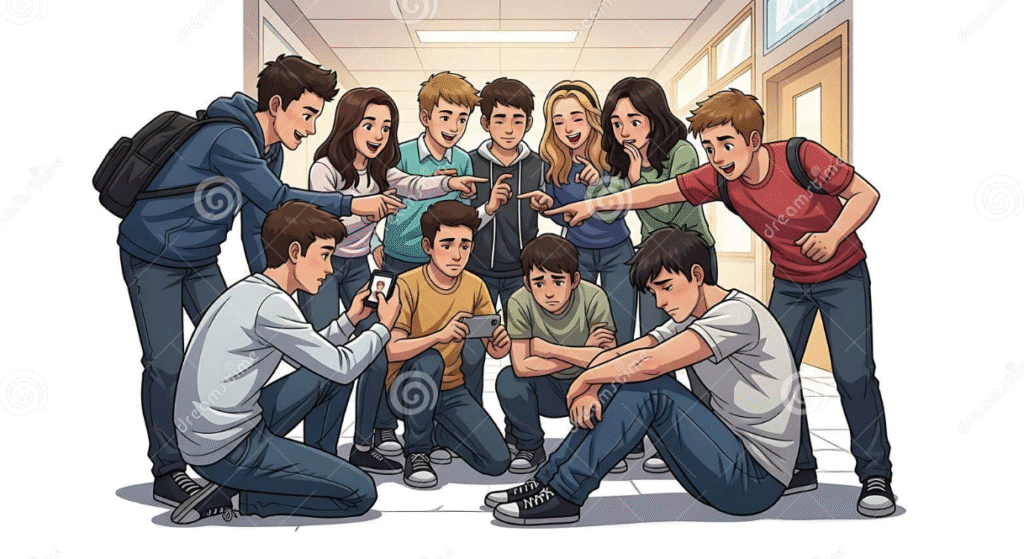

Discover how social media trends and peer pressure can lead to financial struggles. Learn practical tips to reclaim financial freedom and live mindfully.

Keeping Up Is Costing You: The Subtle Start of Financial Peer Pressure

It often begins with a seemingly harmless scroll on Instagram or TikTok. A friend posts their brand-new car. You’re genuinely happy for them, but a quiet thought creeps in: “Why not me?”

Next, your coworker shares photos from their child’s elaborate birthday party—balloon arches, entertainers, themed decorations, and even a professional photographer. Then another post showcases a wedding fit for a movie. Suddenly, your simple life feels… insufficient.

Do you want job? Please click here

We live in a world of constant comparison. Social media bombards us with everyone’s highlight reels, making it feel like we’re falling behind—not because we’re struggling, but because everyone else seems to be thriving. This constant exposure fuels a desire to catch up, leading to financial decisions we often regret.

Back Then: A Simpler, More Grounded Life

A few decades ago, life was less performative. People grew food in their gardens, built homes together, and celebrated important events modestly.

While wealth gaps still existed, they didn’t define social status the way they do today. No one expected you to overspend just to fit in. The focus was on substance over style.

Fast forward to today, and everything has changed. It’s no longer just about affording necessities—it’s about projecting an image of success. Sadly, the cost of appearances is increasingly unbearable.

Living Beyond Our Means to Impress Others

Today, many individuals are accumulating debt not out of need, but from pressure—to own the latest gadgets, host extravagant events, drive luxury vehicles, and enroll kids in elite schools.

These choices might momentarily impress, but they come at a steep cost: sleepless nights, growing debt, and fragile financial security.

Behind polished online images, many are secretly struggling. Loans are taken not for emergencies, but for appearances. Budgets are blown to fit a lifestyle that isn’t sustainable. Emotionally, it leads to stress, anxiety, and a feeling of failure.

Why We Fall into the Trap: The Psychology of Comparison

As humans, comparison is built into our psychology. Social comparison theory explains how we assess our worth based on how we perceive others. But in the digital age, our reference points aren’t just family or neighbors anymore—they’re influencers, celebrities, and strangers with curated lives.

Social media rarely shows real struggles: no mention of debt, missed payments, or financial strain. We end up comparing our real lives to someone else’s highlight reel, and the result is often dissatisfaction and overspending.

The Emotional and Financial Toll of Pretending

The danger of financial peer pressure goes beyond money. Many suffer in silence—unable to talk about the stress of keeping up.

The expensive car might be on a burdensome loan. That luxurious home might be draining the owner’s savings. Yet from the outside, it all looks perfect.

This pressure contributes to mental health issues, broken relationships, and long-term financial instability.

Reclaiming Your Financial Freedom: 5 Practical Steps

- Know What You Truly Value

Before any purchase, ask: Is this for me, or to impress others? Align your spending with your personal goals, not social expectations. - Use the 50/30/20 Budget Rule

- 50% of income: Essentials (housing, food, utilities)

- 30%: Lifestyle choices (entertainment, shopping, dining)

- 20%: Savings or debt repayment

- Limit Social Media Influence

Unfollow accounts that promote unrealistic lifestyles. Follow pages that inspire, educate, and uplift. - Track Your Expenses

Awareness is key. Use budgeting tools or apps to monitor where your money goes and adjust accordingly. - Surround Yourself with Like-Minded People

Build relationships with people who support financial wellness, not flashy consumption.

What to do? Choose Purpose Over Pressure

Peer pressure can lead you down a path of debt, anxiety, and dissatisfaction. But you have the power to break free.

By focusing on financial mindfulness, setting clear priorities, and distancing yourself from toxic social comparisons, you can regain control over your finances and your peace of mind.

Remember: your financial journey is personal, and there’s no need to rush. Wealth isn’t built through competition, but through consistent, intentional choices.

Check out different types of peer pressure here