The National Bank of Rwanda (NBR) has taken a major step in exploring the future of money by organizing a Central Bank Digital Currency (CBDC) Ideathon. This event invites local innovators, startups, and financial institutions to help shape the future of a possible digital version of the Rwandan Franc — the e-Franc-Rwandais.

The Ideathon is part of a broader initiative by the NBR to test whether Rwanda should adopt a CBDC. This journey began in 2023 when the central bank conducted a feasibility study with the support of the Alliance for Financial Inclusion (AFI). The study, which followed global best practices from the International Monetary Fund, looked at both the benefits and risks of digital currency.

Now, the project has moved to the next stage — a Proof-of-Concept (PoC). This step will test how a CBDC could work in the real world, using four key “sweet spots” identified in the study. These areas offer the most promise for improving Rwanda’s financial systems and ensuring broader access to secure and efficient payments.

The CBDC would be a digital form of money issued by the central bank, designed to complement physical cash and existing mobile money systems. It would use a two-tier model where the NBR issues the currency, while banks and financial service providers distribute it to users. This setup keeps the system stable while encouraging innovation.

One exciting feature of the proposed e-Franc is “programmability.” This means the digital currency could have smart features like setting limits, restricting who can receive payments, or automating top-ups based on certain conditions. This could open new doors for social programs, financial inclusion, and more efficient government services.

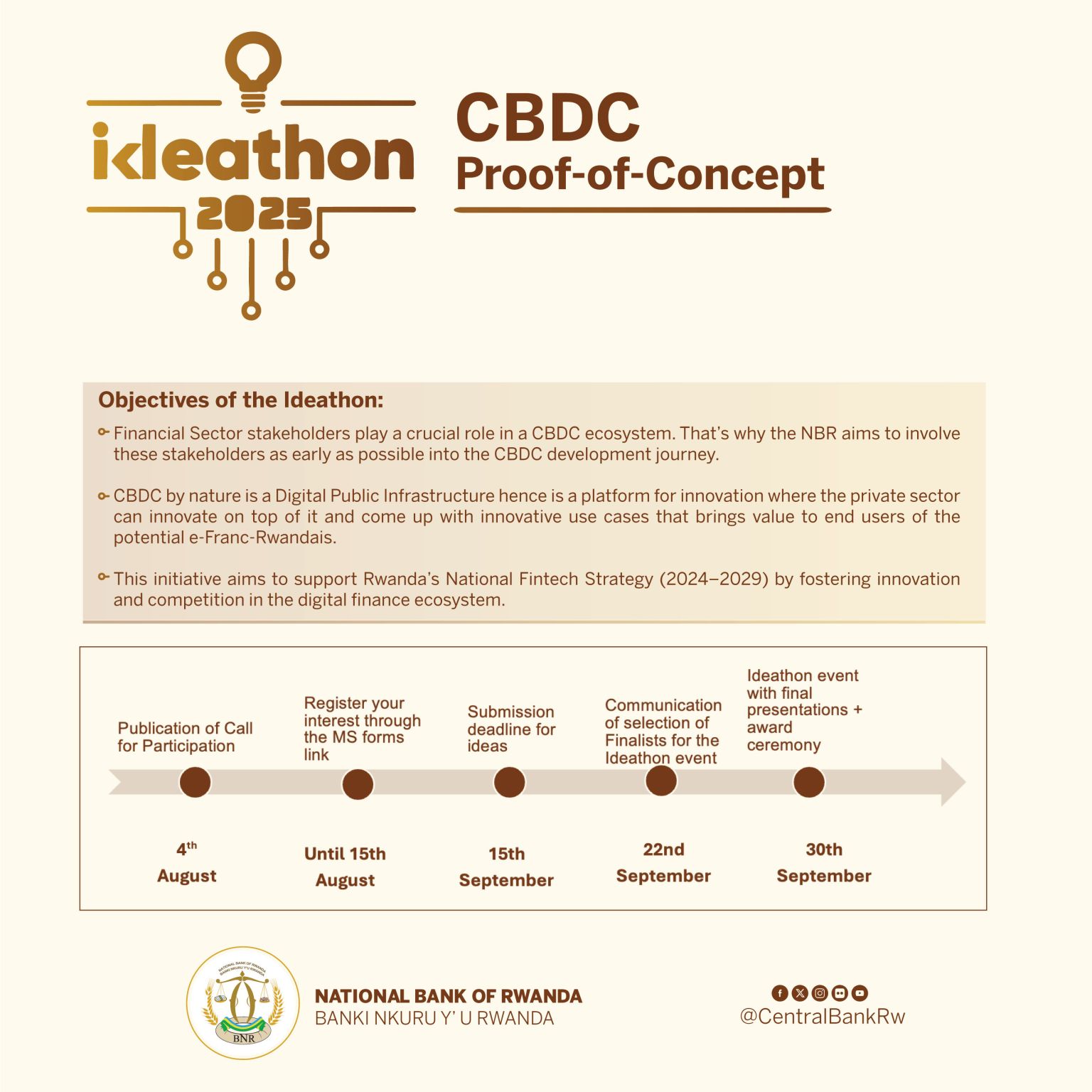

The Ideathon, running from August to September 2025, invites participants to submit their ideas for how the e-Franc could be used in real life. Finalists will present their concepts to a jury composed of experts from NBR and its international partner, Giesecke+Devrient. Winners will be publicly recognized and may have a chance to develop their ideas in future pilot projects.

Importantly, the NBR clarified that no decision has been made yet on launching a CBDC. The current process is still about research, testing, and gathering insights.

This initiative also supports Rwanda’s 2024–2029 National Fintech Strategy, aiming to boost digital innovation, strengthen the financial sector, and promote inclusive growth.

Rwandan institutions, fintech companies, and innovators are encouraged to join this forward-looking challenge and become part of the country’s digital financial future.

dg9fq3