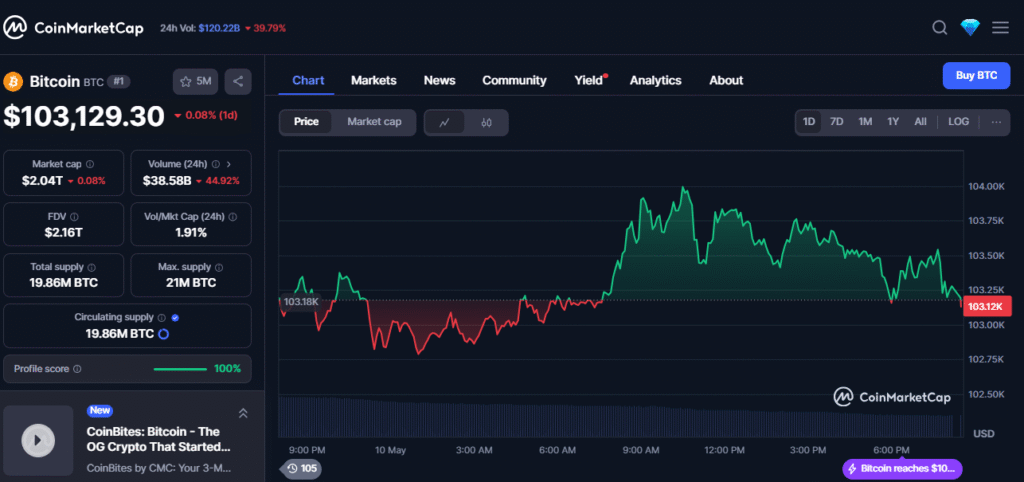

Bitcoin (BTC) has once again taken center stage, surging above the $100,000 milestone for the first time since February 2025. As of May 10, BTC is trading around $103,550, reflecting a 7.32% weekly gain. With a market cap now exceeding $2.05 trillion, Bitcoin has climbed to become the fifth-largest asset globally, leapfrogging tech titans like Amazon and Google.

Institutional Momentum: ETFs Fueling the Rally

One of the biggest forces behind Bitcoin’s climb is the sustained flow of institutional capital into spot Bitcoin ETFs. Over the past three weeks, these funds have attracted more than $5.3 billion in net inflows, reinforcing institutional confidence in Bitcoin’s long-term value.

Among the leaders, BlackRock’s Bitcoin ETF has recorded 19 consecutive days of positive inflows, marking the longest streak this yeara strong signal of rising demand among professional investors and wealth managers.

Corporate Buyers Double Down: Strategy and Metaplanet Lead the Way

Corporate accumulation is another major driver of Bitcoin’s bullish momentum. Strategy (formerly MicroStrategy) has ramped up its holdings to 555,450 BTC, acquired at an average cost of $66,384.56. This bold strategy reflects their unwavering belief in Bitcoin as a strategic treasury asset.

Meanwhile, Japanese firm Metaplanet is following suit, boosting its reserves to 5,555 BTC. Its latest purchase of 555 BTC came at an average price of $96,134, and the company plans to issue $21.25 million in bonds to fund future acquisitions underscoring growing corporate conviction in Bitcoin’s long-term role.

Technical Picture: Bullish But Caution Warranted

Technical indicators currently support a bullish outlook. Bitcoin has cleared key resistance levels, with the next major hurdle seen around $106,000. If breached, analysts anticipate a push toward the $110,000–$115,000 range in the near term.

That said, the Relative Strength Index (RSI) is sitting above 70, a traditional signal that the asset may be overbought. This raises the potential for a short-term pullback or consolidation phase before any further breakout.

Macroeconomics and Policy Tailwinds

Beyond the crypto ecosystem, macroeconomic tailwinds are also lifting sentiment. Recent trade agreements between the U.S. and U.K. have boosted investor confidence in risk assets like Bitcoin.

On the regulatory front, states such as Arizona and New Hampshire have passed laws supporting crypto adoption, allowing state-level participation in digital assets. This growing policy support is further bolstering Bitcoin’s case as a legitimate financial instrument.

Looking Ahead: Is $120,000 Within Reach?

With strong fundamentals, technical momentum, and growing institutional and governmental support, Bitcoin appears well-positioned to challenge its previous all-time high of $109,114.88, set in January 2025.

Analysts at Standard Chartered have revised their projections upward, suggesting Bitcoin could exceed $120,000 during the second quarter of 2025, should current trends hold.

Final Take: Opportunities and Risks Coexist

Bitcoin’s breach of the $100K barrier is a landmark moment that underscores its evolution from speculative asset to mainstream investment. However, as always, caution is key. The crypto market remains highly volatile, and unexpected developments from regulatory shifts to geopolitical events can influence price trajectories.

Investors are advised to stay informed, monitor both technical indicators and macro trends, and approach the market with a balanced strategy that weighs both the upside potential and inherent risks.