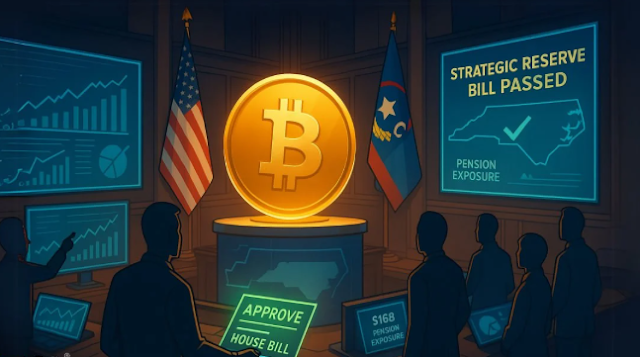

On April 30, 2025, the North Carolina House of Representatives passed House Bill 92, known as the Strategic Bitcoin Reserve Bill. This bill allows the state to invest in Bitcoin-related financial products like mutual funds and ETFs instead of buying Bitcoin directly. It also lets state employees invest part of their pension funds in cryptocurrencies.

Supporters believe this could help improve the state’s finances, especially with a $16 billion pension deficit. Investing in digital assets could diversify the state’s portfolio and possibly increase returns.

Before it becomes law, the bill still needs to be approved by the North Carolina Senate. If passed, North Carolina would join other states exploring the use of cryptocurrencies in public finance.

Arizona Led the Way with a State Bitcoin Reserve

Earlier in 2025, Arizona became the first U.S. state to create a Bitcoin reserve, planning to invest 10% of its $31.5 billion in assets into cryptocurrencies. This move shows a growing interest from governments in using digital assets to diversify investments and protect against inflation.

Federal Government Takes Action

In March 2025, President Donald Trump signed an executive order creating a U.S. Strategic Bitcoin Reserve. This includes digital currencies like Bitcoin, Ethereum, XRP, Solana, and Cardano, mostly gathered from legal seizures. The reserve uses existing assets and doesn’t require new taxpayer money.

The goal is to strengthen the U.S. economy by supporting cryptocurrency and making the country a leader in the digital financial world.

A Growing Global Trend

The efforts by North Carolina, Arizona, and the federal government reflect a bigger shift: cryptocurrencies are becoming more accepted in public finance. What was once seen as risky is now viewed by many as a smart investment strategy.

This trend is global—El Salvador, for example, has made Bitcoin legal tender, and other countries are exploring similar ideas. More regulation and the rise of Bitcoin ETFs are helping build trust in digital assets.

What This Means for the Future

If managed well, adding digital currencies to government investments could bring better returns and diversified portfolios. But since crypto markets are still volatile, careful planning and oversight are necessary.

Other states will be watching closely. If Arizona and North Carolina succeed, more states might follow, leading to wider adoption of crypto in government finance.

Conclusion

North Carolina’s move with House Bill 92 is a big step toward using cryptocurrencies in public investment. Along with federal efforts and Arizona’s example, it shows that digital assets are becoming part of modern finance. Going forward, the key will be balancing innovation with safety and smart regulation.

j19in6

petoskey casino

References:

http://157.230.187.16:8083/home.php?mod=space&uid=572889

hollywood casino toledo ohio

References:

https://ashkert.am/%D5%A1%D5%B7%D5%AF%D5%A5%D6%80%D5%BF%D5%AB-%D5%B0%D5%A1%D5%B4%D5%A1%D6%80/blackcoin/

wizard of odds blackjack

References:

https://git.unillel-paraversum.de/sadyesong4266

europe casino

References:

https://gogs.artapp.cn/delilahkeller/6841best-online-roulette-australia/wiki/Top+List+of+Australian+Casinos+Expert+Picks+for+2025

royal casino online

References:

http://www.webclap.com/php/jump.php?url=http://volleypedia-org.50and3.com?qa=user&qa_1=raygarztzg

choctaw casino pocola ok

References:

http://images.google.vu/url?q=http://www.wykop.pl/remotelink/?url=https://www.sierrabookmarking.win/are-there-casinos-in-or-near-branson

Sie werden aber regelmäßig auf Crypto-Casinos stoßen, die eine Auswahl

an hauseigenen Spielen anbieten, die Sie in keinem anderen Casino sehen. Unsere Forschung hat gezeigt, dass Krypto-Casinos im Vergleich zu traditionellen Online-Casinos viel

mehr Spiele anbieten – und es kann schließlich niemals genug Spiele geben! Kryptowährungstransaktionen werden über

eine digitale Wallet durchgeführt, die nicht

mit Ihrer Identität verknüpft ist. Kryptowährungstransaktionen laufen rund um wie eine Uhr und rund um die Uhr.

Krypto-Casinos haben in der Regel niedrigere Mindesteinzahlungen jedoch keine maximalen Einzahlungslimits.

Im Vergleich zu herkömmlichen Online-Casinos bietet ein durchschnittliches Krypto-Casino sowohl

höhere Willkommensbon als auch tägliche,

wöchentliche und monatliche Bonusangebote. Obwohl es keine dedizierte mobile App gibt,

bietet Kripty Casino ein frisches und zuverlässiges

Spielerlebnis, das sowohl neue als auch erfahrene Spieler begeistern wird.

Das bedeutet zwar nicht zwangsläufig, dass Sie im Bitcoin Casino ohne Verifizierung spielen können. In beiden Fällen handelt es

sich um Online-Spielotheken mit einer breiten Auswahl an Slots, Tischspielen und

Live-Angeboten. Wenn Sie im besten Bitcoin Casino

spielen möchten, müssen Sie zunächst einige Basisschritte absolvieren. Anschließend werden Stammspieler

mit wechselnden Aktionen für ihre Treue belohnt.

Ein renommierter Background und die gültige Lizenz sorgen dafür, dass Sie sicher und legal im Bitcoin Casino Online spielen.

References:

https://online-spielhallen.de/nine-casino-uk-150-150-freispiele-premium-gaming/

Diese umfangreiche Sprachunterstützung richtet sich an ein vielfältiges globales Publikum und erleichtert es Spielern aus verschiedenen Regionen, auf das Casino zuzugreifen und Unterstützung in ihrer

bevorzugten Sprache zu erhalten. Insgesamt sind die Zahlungsmethoden und -richtlinien von Verde Casino solide und bieten den Spielern eine

breite Palette an Auswahlmöglichkeiten. Kryptowährungen bieten zusätzliche

Privatsphäre und Geschwindigkeit bei Transaktionen, was sie

für viele Spieler attraktiv macht. Die Zahlungsmethoden und unterstützten Währungen von Verde Casino

bieten eine große Auswahl an Optionen, was im Allgemeinen positiv für die Spieler

ist. Verde Casino bietet wettbewerbsfähige Quoten für Sportwetten und virtuelle Sportarten, darunter Fußball,

Tennis und Basketball. Zu den Live-Casino-Spielen gehören Blackjack, Speed Roulette und Baccarat, die ein Erlebnis wie in Las Vegas bieten.

Der Neukundenbonus wird automatisch durch die ersten Einzahlungen aktiviert.

Um den vierten Einzahlungsbonus inklusive Free Spins abstauben zu können, ist eine Einzahlung von mindestens 15$ nötig.

Auch die vierte Einzahlung wird mit einem großzügigen Einzahlungsbonus belohnt.

References:

https://online-spielhallen.de/verde-casino-promo-code-2025-25e-no-deposit-boni/

hunger games online game

References:

https://obyavlenie.ru/user/profile/603402